In local fixed income, given the significant drop in yields on time deposits, it still seems reasonable to move along the risk-return curve from low-risk but very low-yielding assets to fixed-income assets with a higher rate but somewhat higher risk.

We project high accruals for UF funds in the coming months. Inflation is expected to remain on the rise in the coming months as a result of withdrawals from pension funds and some supply shocks.

We recommend maintaining a duration in the middle part of the curve (up to 5 years), with an overweighting of UF and a slightly less conservative strategy in terms of corporate risk, given the context of a recovering economy with the vaccine making significant progress.

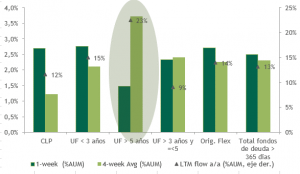

Flows have also become more dynamic locally. Abundant liquidity, the Central Bank's moderate tone and rising inflation expectations, which imply attractive yields for UF funds in the coming months, have led to strong inflows to fixed income funds in recent weeks, especially to tranches up to 5 years in duration. So far in February alone, we have seen inflows of over US$730 million to mutual funds over 1 year, with the largest inflows concentrated in UF funds in the 3 to 5 year duration tranches (see attached chart).

Thus, the high inflows into the mutual fund system, which are likely to continue for the next few months, augur spread compression and further rate declines.

In particular, the #FYNSA DEUDA CHILE fund maintains a UF positioning over 90% of the portfolio. The fund continues to avoid the 10-year portion of the curve, given the political uncertainty and an almost certain structural increase in the fiscal deficit over the next few years, which would keep yields on these maturities under pressure.

This strategy of overweighting UF, with a limited duration (3.7 years) and taking care of credit quality, has allowed the fund to outperform so far this year (+3.14% as of February 18).has allowed the fund to outperform so far this year (+3.14% as of February 18).

Flow FFMM Fixed Income > 1 year by term and currency (% AUM)