On Thursday, European Central Bank decision-makers sat down for their first monetary policy meeting, after they abandoned their long-standing inflation target of "below, but close to 2%" in favor of a new symmetric target centered on 2%. That decision formalized the ECB's shift away from its Bundesbank-style focus on price stability and enshrined its role as the eurozone's "guardian of financial stability." However, ahead of Thursday's meeting, investors had yet to know with certainty how the ECB's change in strategy would affect (i) the outlook for eurozone interest rates and (ii) the future of ECB bond purchases. These questions have now been answered.

On interest rates, the ECB was unequivocally and emphatically dovish. There was never any doubt that the council would signal that rates will remain at rock-bottom for an extended period of time. But comparing the ECB's new forward guidance with historical data underscores how unlikely any increase in medium-term rates is. The ECB expects interest rates to remain at their current levels or lower until three conditions are met.

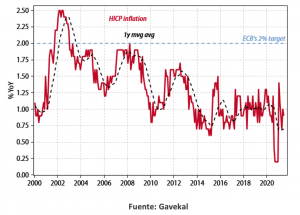

This raises the bar for future rate hikes. In the past, ECB forecasts sometimes projected core inflation converging towards 2% over the medium term, for example, in June 2018 (which was one of the factors behind the ECB's decision to stop net asset purchases at the end of 2018). But actual realized core inflation did not meet the ECB's forecasts. As the accompanying chart shows, the last time Eurozone core inflation touched 2% was in March 2008. The one-year moving average of core inflation has not risen above 1.2% since 2013. Combined with the first two conditions, this virtually guarantees that there would be no rate hikes until 2024 at the earliest.

The ECB did not directly address the future of its asset purchases on Thursday. Currently, most of its net purchases are made under its pandemic emergency purchase program, or PEPP, which costs about €80 bn a month compared with a €20 bn a month limit for its regular asset purchase program, or APP. Given that the PEPP will expire in March 2022, the ECB will have to extend the PEPP or increase the size of the APP if it wants to avoid market destabilization by abruptly reducing its net asset purchases by €80bn per month.

Indirectly, the ECB's future interest rate guidance has implications for the future of its asset purchases. The ECB has said it expects to end net asset purchases shortly before it raises rates (although it will continue to refinance maturing bonds after that). As a result, the ECB's commitment on Thursday to keep interest rates lower for longer also amounts to a commitment to keep its net purchases in the bond market for longer.

Eurozone core inflation has not exceeded 2% since the beginning of 2000