When we started this column, the idea was to explain in simple terms some economic phenomena of the conjuncture, of the day to day or even some that probably would not be identified as "economic" as such. We did some of that, but you will understand that a series of events during the last time made us migrate our gaze towards issues related to the deep national debate in which we are involved.

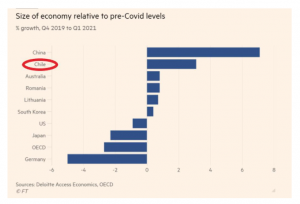

However, a publication that began to circulate through social networks and e-mails from the financial sector caught my attention. Not only because of the boldness of the title, but also because the source seemed serious and reliable. It was a graph that showed those countries that had left behind the aftermath of the pandemic and that today would have a larger economy than the one that existed prior to Covid-19. Of course, it also included those that are still lagging behind. But see for yourselves:

Thus, we appreciate that the economies of China, Chile, Australia, Romania, Lithuania and South Korea would be larger relative to what they were pre-pandemic. Methodologically, compare the GDP of the 1st quarter of 2021 against the 4th quarter of 2019, for a set of countries. If the variation is positive, the economy would be larger, while, if negative, the opposite. Trying to replicate the exercise for Chile, we realize that it was performed with the seasonally adjusted GDP series and that it was not annualized. Thus, the result obtained is 3.1%.

I have several apprehensions about this. The first has to do with the concept of "size of the economy". Evidently the authors consider that this would be a flow (GDP by definition is), while for me it would be a stock. Call me (neo)classical, but for me the size of the economy at a given moment is the result of some production function that depends on the stock of physical capital, human labor and productivity. A stock.

"Ya, but Nathan, what a latero, let's not reduce the problem to a semantic issue, give us something more attractive than that.". Yes, they are right. Let's ASSUME for a moment that the size of the economy is GDP (*my eye twitches). And that deseasonalizing is enough to make GDPs corresponding to different quarters moderately comparable (ugh!). Wanting to homogenize, the author selected the 4th quarter since for most countries it was still a normal quarter. But we know that for Chile it was anything but normal. During this quarter, activity contracted by 2% year-on-year (4% if we do not consider December) after the social outburst, which significantly reduces the basis for comparison. Abusing the methodology, in a monthly look (using the seasonally adjusted Imacec), we conclude that as of April, the economy was 3.1% smaller than in September 2019, which you can appreciate in the following chart:

This figure shows us that the monthly production level in April 2021 is 3.1% lower than it was in September 2019, controlled for seasonal effects. Therefore, breaking it down a bit further, we realize that we are not yet at pre-crisis levels.

But that is not the whole story. The chart above highlights an ellipse, showing the loss, in level, of the two crises. That can be valued; we can know how much we stopped producing between Q4 2019 and Q1 2021. To do so, I will make a conservative assumption and that is that during that period we would have grown at the same rate as the average of the last 80 months: 2.4% per year (or 0.2% m/m seasonally adjusted). Thus, during this period, we have lost approximately US$28 billion in production. If we want the economy to recover all this recessionary phase, it is not enough just to reach the level we had before, but also to recover that loss. If we settle for returning to growth as we did before, we will be US$28 billion poorer forever. And in a context in which social demands are pressing, this is not a luxury we can afford.

So, folks, when you see any kind of graph or information like this, be hesitant. Allow yourself to be skeptical. Even doubt this column I have written, if I have failed to convince you. Not because of my title or my position, or because I am a "big four"I am going to be right. Judge our ideas or our arguments, this is the only way to move forward. For the time being, baker to your cakes.

Nathan Pincheira

Chief Economist of Fynsa