According to the latest round of global business surveys, loss of momentum from the second wave of the pandemic was modest and short-lived. The survey continues to highlight stronger gains in the goods-producing sector than in the services sector. Encouragingly, however, February's aggregate increase for all industry is due more to a rebound in the services sector PMI.

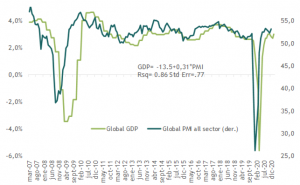

JP Morgan's global all-industry PMI rebounded 0.9 points in February, which is consistent with annualized global GDP growth of 3.0%.%. The news in this month's report comes from the global services sector, with the output index jumping 1.2 points in February, just 0.1 points below its expansion peak of 52.9.

Regionally, the strength in February's services PMI was concentrated in developed markets. While each of the major economies posted an increase, the United Kingdom far outperformed the rest of the group with a 10-point jump. In emerging markets, China's services PMI adjusted a bit from its previous peak with a 0.6 point drop in February to 51.5. The rest of the emerging markets were mixed with a stable print in Mexico, an increase in Brazil and a decrease in Russia.

With respect to the forward-looking message from the February surveys, the all-industry new orders PMI rose to a solid 52.5 from 51.8 in January. Notably, a 0.4-point drop in the manufacturing orders PMI was more than offset by a sharp 1.1-point jump in service orders.

A message of moderation is coming from global labor market surveys. While the 50.1 reading for the global all-industry employment PMI, unchanged last month, which is arguably consistent with a global economy expanding below potential, does not add to the upside risk signal sent by the strong activity readings.

Perhaps the most telling signal from the global PMIs is in price expectations.. After a brief respite in September on their road to recovery, global price PMIs for all industries have soared to levels not seen since before the global financial crisis.

Global output PMI

PMI vs World GDP