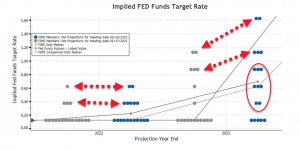

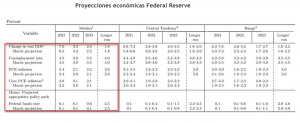

The Fed kept benchmark rates and the pace of bond purchases unchanged, but the biggest change is a more aggressive tilt in its rate forecasts, with the Fed's median projections showing 2 rate hikes by the end of 2023 and 7 FOMC members seeing a hike in 2022.

On the economic front, the biggest adjustment is in this year's expected inflation, which they continue to characterize as "transitory". There were no unnecessarily moderate hints of higher unemployment in 2023, which was unchanged from the latest projection. What did change was a slight increase in 2023 GDP, from 2.2% in March to 2.4%, while PCE inflation also increased from 2.1% to 2.2%, giving the Fed some room to forecast 2 rate hikes in 2023.

Fed Chairman Jerome Powell sees no reason to turn around and start aggressively tightening and reiterated his view that (i) much of the current inflation is due to transitory factors, (ii) inflation expectations are above target, but still within an acceptable range given the Fed's willingness to keep inflation moderately high for a while, and (iii) the U.S. labor market has some slack.

We believe that the FED had to signal higher interest rates because of higher inflation surprises, but that they would stretch asset purchases as far as possible and the market is much "more sensitive to liquidity" (see attached charts) than to a little more TPM. Otherwise there is still a lot of debt to "monetarize".

The tug-of-war between above-trend growth and policy normalization is what will define the direction of markets in 2H21 and beyond... And although the Fed was somewhat more hawkish than expected, growth is likely to continue to set the tone over the coming months. This global dichotomy favors equities, emerging markets, value, commodities and cyclical behavior. We see the reflation and reopening that took place in the US migrating to Europe and starting in EM.