As the recovery runs its course, markets will begin to adjust to "tighter" monetary conditions, a process that will likely inject volatility, but will also bring opportunities.

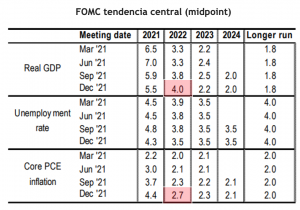

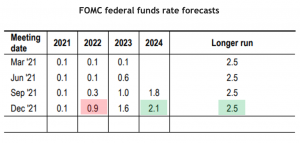

The FOMC left the funds rate target range unchanged at 0-0.25% at the December meeting. Citing elevated inflationary pressures and further improvement in the labor market, the Committee announced that it will double the pace of tapering to $30 bn on the month in January. The dot plot showed a baseline of 3 rate hikes in 2022, 3 hikes in 2023 and 2 hikes in 2024, a "more front-loaded" pace, but shallower than expected. Two-thirds of participants projected 3 or more hikes next year - an aggressive development - but most participants did not forecast tightening policy over the forecast horizon . As expected, the statement removed any reference to transitory factors in its characterization of inflation and instead noted that supply and demand imbalances "continued to contribute to elevated levels of inflation."

There were three substantial revisions to the FOMC statement: (1) dropping the categorization of inflation as transitory (2) pointing to new variants as a risk and (3) updating the forward guidance to remove the reference to inflation below 2 percent, and adding to the guidance that achieving full employment is the last hurdle before liftoff. Overall, the near-term signal on policy intentions was within expectations, stating that they point to liftoff sometime in the second and third quarters of 2022 (in this sense the first rate hike being in June seems most likely to us).

In looking at the economic and interest rate projections there are a couple of things that seem relevant to us with respect to the impact on the various asset classes and our projections for 2022.

In this context, our view remains that 2022 will be the year of a full global recovery and the end of the global pandemic, thanks to the achievement of broad population immunity and new therapies. We believe this will produce a strong cyclical recovery, a return of global mobility and a release of pent-up demand from consumers (e.g. travel, services) and corporations (inventory recovery, capital investments and buybacks), in a context where monetary policy will remain accommodative.

For this reason, we remain positive on equities, commodities and emerging markets, and negative on bonds. We expect outperformance of cyclical and value assets, recovery of riskier and more volatile assets, and headwinds for defensive sector bonds and market segments that benefited from the pandemic. As the recovery runs its course, markets will begin to adjust to tighter monetary conditions, a process that is likely to inject volatility.

The main risk to our view? Uncertainty around high inflation and monetary policy normalization.

Humberto Mora

Strategy and Investments