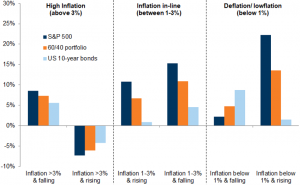

In previous issues we have argued that the impact of changing inflation on stocks depends on the initial level of inflation and the direction of travel.

The combination that tends to be most favorable for equity markets is when inflation is rising from very low levels (and deflation risks are diminishing) or when high levels of inflation are moderating. As the chart shows, for stocks, bonds and balanced funds, higher inflation (above, say, 3%) that is rising tends to be the worst outcome, while inflation above 3% and falling is much more benign. For equities in particular, the best returns tend to occur when inflation is below 1% but rising; this is often associated with a recovery from a recession and also with reduced risk of deflation (and is therefore not particularly favorable for bond markets).

Stable yields with inflation within range: reversal of extremes tends to be bullish

Now, as we showed earlier in the PMIs, the last few months have seen a significant increase in PMI input prices, and these pressures could eventually spill over to overall consumer price inflation. Add to this that many companies reporting 1Q21 results have been mentioning inflationary pressures.

So the question that follows is what would happen if we move from "higher transitory inflation" (baseline scenario), to higher persistent inflation" say above 3% (risk scenario)?

First, duration should be shortened further and reallocated from bonds to commodities and equities. Commodity indices (such as the S&P GSCI) are perhaps the most direct inflation hedge. Commodities are also cheap in a historical context: they are the only major asset classes that declined in absolute terms over the last decade (the underperformance is significant and largely due to falling energy prices). Since 2010, the S&P 500 quadrupled and the S&P GSCI index declined by almost 40%.

Within equities, buy value and a low volatility short style. Growth and quality also have a negative correlation with inflation.

The expectation of higher rates is lifting "value" stocks that are cheap relative to current earnings and thus may be considered short-lived. Meanwhile, "growth" stocks that are expensive relative to current earnings and are therefore long duration are struggling on a relative basis. In this environment, the financial sector can provide a hedge against a sharp rise in long rates, while commodities offer a hedge for higher inflation.