Real estate leasing is a financing alternative that allows companies to choose a real estate asset, ask a financial institution to purchase it, and have it leased to them with a purchase option at the end of the contract. In other words, it is a contract whose exclusive purpose is the assignment of the use of real estate, acquired for that purpose according to the specifications of the future user, in exchange for a consideration consisting of periodic installment payments. Thanks to it, companies have the possibility of accessing personalized financing according to their availability and capabilities, in addition to certain tax benefits.

For financial institutions, leasing is an asset with a certain profitability, given by the lease payments for the period and a hedge in case of default or non-payment, given by the real estate collateral.

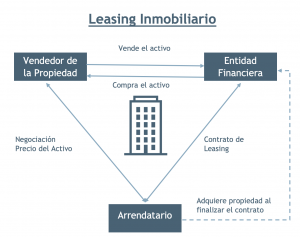

As can be seen in the following diagram, three parties are involved in these transactions: the seller of the property; the entrepreneur who requires the use or benefit of such property; and the leasing entity, which acquires the asset at the indication of the entrepreneur and assigns its use in exchange for the payment of installments.