The high premium that equities continue to offer relative to real interest rate levels continues to justify their overweighting relative to fixed income.

Last week we argued that by balancing the negatives (tighter policies and high valuations) with the positives (low recession risk), investors are advised to maintain a more or less neutral risk exposure. ( https://www.fynsa.cl/newsletter/politica-monetaria-2/)

This week we will delve deeper into what this means in practice in terms of the potential for U.S. equities.

It is true that the market has so far digested relatively well the "harder tone" set by the Fed, with the understanding that the Fed will be able to achieve a "soft landing of the economy" and not make a policy mistake that will end in a recession .

We subscribe that for now the risks of recession are limited and that the U.S. economy is in good shape to absorb a less friendly monetary policy and therefore the expected corporate earnings growth of around +8% for S&P 500 companies would not be "at risk".

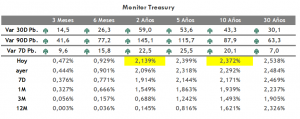

Now, as inflation risks remain high, at least for the first half of 2022, the market has been leaning towards a more aggressive monetary normalization process than the one set by the Fed just a week ago or, in other words, the guidance for the next 2 years of federal funds rates (2.8%), could end up being brought forward almost completely for this year .

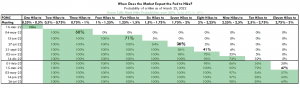

Proof of this is that expectations of further rate hikes for the May and June FOMC meetings have begun to incorporate a growing probability of 50 bp per meeting (+68% and +71% probability, respectively), strengthened by Powell's own statements and those of other Fed members in recent days who have made it clear that "priority" today is price stability. The attached table also shows that the probability that the rate will end this year at 2.8% has already reached 32%, a low but increasing probability.

Of course, this is putting additional pressure on market rates, with the 2-year treasury trading above 2.1% and 10-year rates almost at 2.4%, which is pretty much the levels we expected for 2022, but which we now believe could be closer to 2.7%. Implicit in this is a further flattening of the yield curve and potential inversion of the curve later in the year.

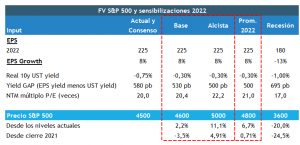

With this in mind, we see very limited multiple expansion potential for equities, and the upside potential is played entirely on expected corporate earnings growth.

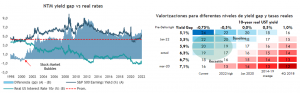

For the time being, the market is supported by real rates that remain very expansionary (-70 bps for the 10-year), levels that we consider very low compared to other monetary normalization processes. While it is difficult to underwrite positive real rates, given the "higher tolerance" for inflation than in past cycles, we do believe that real rates could very well approach more neutral levels going forward.

All in all we are adjusting our projections for the S&P 500 to levels of 4,600 points, consistent with an expected EPS of US$225 per share, a P/U fwd multiple of around 20x and 10-year real rates of -0.3%. Implicit in this is some ERP (equity risk premiun) compression from the current 580bp to levels closer to 530bp, which are basically the levels prior to the geopolitical crisis in Ukraine.

The high premium that equities continue to offer relative to real interest rate levels continues to justify their overweighting relative to fixed income.

As the question is recurring, we are incorporating a sensitization for a potential recession scenario, taking as a baseline the average EPS decline around recessions (-13%), whereby the S&P 500 would adjust to 3,600 levels matching the median recession adjustment (-24%).

If geopolitical and inflation pressures ease later in the year, our bullish case considers levels closer to 5,000.

Humberto Mora

Strategy and Investments