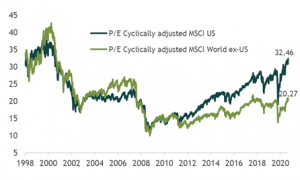

While valuations are historically expensive for US stocks, especially for "growth stocks", this is not generally true for stocks outside the US, this is not generally true for stocks outside the U.S. The Shiller - type CAPE (cyclically adjusted P/U) for non-U.S. markets is as low today as it was 20 years ago.

Long-term yields for U.S. equities are expected to fall to lower levels over the next few years as a result of mean reversion and reflect very low interest rates. But outside the US, this mean reversion has already occurred, as has the adjustment to very low risk-free yields. In fact, mean reversion in Europe, Japan and the UK would suggest higher equity returns over the next decade, as opposed to the lower returns implied by the overvaluation of US equities. Therefore, the rotation from U.S. to non-U.S. markets that began late last year is likely to gain momentum. The same should be true for the rotation from growth to value.

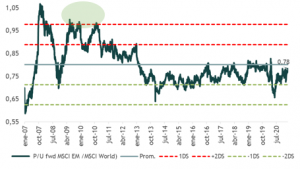

And in the case of emerging markets, despite the good performance of the last few months, they are still trading at a discount of more than 20% to the developed world, they still trade at a discount of more than 20% with respect to the developed world.

It is interesting to start looking at the post-financial crisis period (until the end of 2010), with massive monetary stimulus, dollar weakness and a commodity bull cycle, which may well begin to compare with the current period and where emerging equities once traded once the developed markets.

MSCI US vs MSCI World ex-US P/E Cyclically Adjusted P/E (CAPE).

Relative valuation MSCI EM vs MSCI World