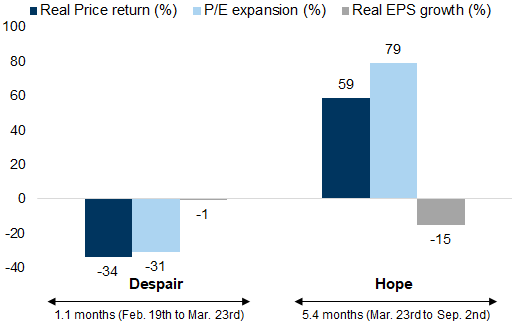

The initial powerful rally in equity markets between March and September of last year, driven by valuation, is very typical of the initial 'hope' phase of a bull market, which usually begins during a recession when earnings are still falling.

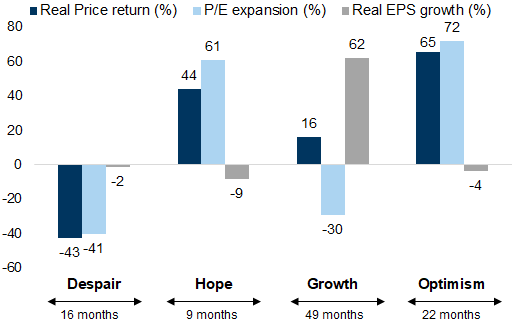

This phase is usually followed by what we call the 'growth' phase, which is the expectation for this year, as global equities generate earnings growth of around 35%.

Often, the transition between the two phases is marked by increased volatility and market and a market setback as investors expect, or begin to doubt, the recovery to be priced in, as we saw after the initial strong rally in equity markets in 2009.

The typical pattern of the stock market cycle

S&P 500. Average of market cycles since 1973

We are currently entering the "Growth" phase of the new cycle.