As a reader of our newsletter you already know that our base scenario for the IPSA is 5,200 points, which already recognizes the higher implied risk of investing in CHILE.

We have incorporated a bearish scenario that assumes a 50 bp higher cost of capital for companies (which is what we have seen reflected after the third withdrawal of pension funds). Thus the IPSA is now trading close to that risk scenario (4,600 points).

Local equities face this weekend's election already incorporating a relevant punishment, trading at 12x forward earnings (the minimum valuation level after October 2019).

This punishment is not only local, but also regional. Although we have seen a great recovery of the IPSA in recent months, it still looks attractive compared to Latin America and even more so compared to emerging markets, seen from the perspective of PU and Bolsa Libro.

We believe that such a wide discount with respect to the region as the one we had on October 18, 2019 or for the worst of the pandemic would no longer be justified, since we will grow more, there has been a better management of the pandemic and we have a successful vaccination process. Today the IPSA is trading at a discount of almost 40% with respect to Latam in B/L terms.

In addition, today we have a substantial improvement in terms of trade (the best in the last 20 years). (the best in the last 20 years).

As it is, we believe the risk is asymmetric from current levels, with a lot of bad news already built in.

Sensitizing greater political risk.

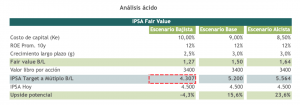

But in view of this weekend's elections, we wanted to stress our models even more and incorporate a more acid test for the IPSA.

A first approximation is to assume a growing deterioration of risk perception, and therefore higher risk premiums, associated with institutional political deterioration and higher fiscal deficits.

Today Chile has an A rating. We assume in the first instance an additional deterioration of the credit profile in the medium term, but without losing investment grade, which in practice would bring us closer to Colombia, which today has a BBB- rating; that is a delta CDS or spread of +90bp, to which we could add an equilibrium treasury 10 closer to 2.0%.

With that in mind and sensitizing the important variables:

In this case, the bearish scenario would be closer to 4,300 points (-5.0% from current levels). (-5.0% from current levels). We believe that this is what we risk in the face of a particularly complex second half of the year, in the midst of the constituent process and a presidential election (see acid analysis table).

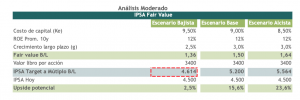

Of course, compensatory effects can be incorporated, given the greater external dynamism and higher copper prices, which could lead to higher ROE levels (in previous cycles we had ROEs closer to 15%). (in previous cycles we had ROEs closer to 15%).

+

+