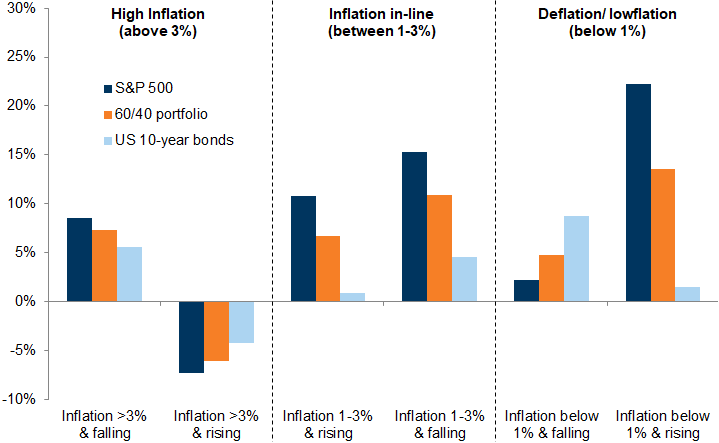

The impact of changing inflation on stocks depends on the initial level of inflation and the direction of travel.

The combination that tends to be most favorable for equity markets is when inflation is rising from very low levels (and deflation risks are diminishing) or when high levels of inflation are moderating. As the chart shows, for stocks, bonds and balanced funds, higher inflation (above, say, 3%) that is rising tends to be the worst outcome, while inflation above 3% and falling is much more benign.

For equities in particular, the best returns tend to occur when inflation is below 1% but rising; this is often associated with a recovery from a recession and also with diminishing deflationary risk (and therefore not particularly favorable for bond markets). (and therefore not particularly favorable for bond markets).

Stable yields with inflation within range: reversal of extremes tends to be bullish