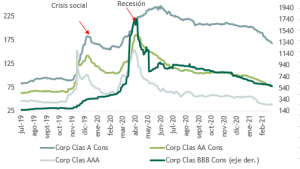

With a so far successful vaccination plan, the market should continue to discount better prospects for the economy in 2021, and with it improvements in companies' credit risk. This has already been reflected in further spread compression. In addition to the known trend for AAA-rated bonds (already expensive), there is an increased appetite for AA and A bonds.

We believe this justifies a less conservative strategy in terms of corporate risk.

In particular, the relative spread of A loans compared to AAA loans is currently A +2DS compared to their long-term averages of 60 basis points.

Corporate spreads by risk rating

Relative spread A - AAA (bp)