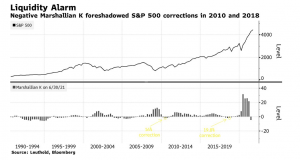

M2 money supply growth in the U.S. is slowing, with a lower rate than GDP growth in recent months, generating concern among some market players. During the second quarter of 2021, the M2 money supply in the U.S. grew 12.7% from a year earlier, compared to nominal GDP growth of 16.7%, according to Bloomberg. In 2010 and 2018, this decoupling translated into downward adjustments in stock prices, although no such effect occurred in the 1990s. Pessimists are looking at the phenomenon with caution: the S&P continues to set records, but stress that few stocks have participated in recent rallies, suggesting that this may be an effect of lower liquidity. Optimists focus on total liquidity, noting that M2 is now more than US$5 trillion (millions of millions) above pre-pandemic levels. In other words, there is liquidity to spare. In any case, it is an indicator to monitor.