No change. The U.S. Federal Reserve will keep the interest rate at current levels of 0%-0.25% until at least 2023. That was the decision of the majority of the members of the Federal Open Market Committee at its March meeting. In addition, Jerome Powell, Chairman of the Fed, stressed that it is not yet the time to talk about a reduction in asset purchases by the monetary authority.

The Fed's decision goes against the grain of a sector of the market that is betting on a rate hike before 2023 and has caused U.S. Treasury yields to rise, putting downward pressure on stock prices, especially growth stocks.

The Fed expects a temporary rise in inflation this year - closing at 2.4% this year - to the 2% target by 2022. Powell said that, although the U.S. economy has improved its performance, there are still sectors that have been hit hard by the pandemic. Unemployment, meanwhile, has fallen, but there are still 9.5 million more unemployed than a year ago.

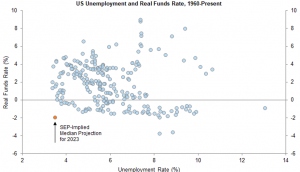

On the other hand, the Fed's Summary of Economic Projections (SEP) revealed a moderate reaction function (or what Chairman Powell called the officials' "target function"). By 2023, the average FOMC participant sees a 3.5% unemployment rate, three years with inflation at or above target, and yet no increase in the federal funds rate (see Chart 2). This looks like a more subdued reaction function than what markets are currently discounting. For example, the Fed's projections for PCE inflation are only about 15-20 bps per year below current market pricing and yet markets see a funds rate of about 0.75% by the end of 2023.

All in all, the Fed's projections should give investors reasonably high confidence that temporarily high GDP growth and inflation, as long as they are in line with the committee's expectations, will not result in early rate hikes, which would still be good support for risky assets and keep the dollar under pressure, will not result in early rate hikes, which would still provide good support for risky assets and keep the dollar under pressure.

Fed projections show a combination of low unemployment and low real rates

Source: Goldman Sachs