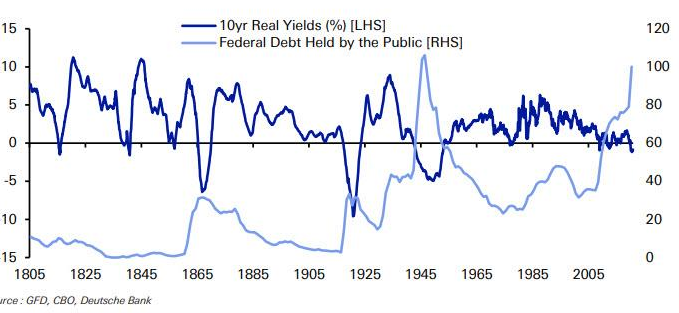

Continuing with interest rates, the accompanying chart shows real yields from over 200 years ago where it highlights that the only time real yields are negative for any time period is in episodes of high debt. Given current debt levels, real yields are likely to remain very low as far as the eye can see, even if we are now seeing some cyclical pressure.

Therefore, with debt so high and likely to increase markedly, real yields are likely to have to remain artificially low for a very long period of time. Any return to anything close to long-term averages would have serious consequences for debt sustainability. The Fed is likely to intervene long before this point is reached.