In recent years there has been an increase in the appetite of investors for real estate businesses in the United States and Chile has been no exception. According to data from ACAFI, in the last two years the investments of Chilean real estate funds in the U.S. have more than doubled.

The United States has the world's largest economy with a 2020 GDP of USD 21.5 trillion1and a total population of 332 million people, 206 million of whom are in the workforce, making it a major source of business opportunities.

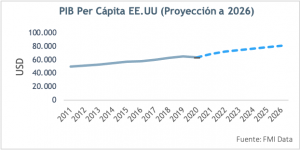

The country's GDP per capita currently stands at USD 64,000 per year, and according to International Monetary Fund estimates, it should reach USD 80,000 by 2026. (see graph 1)

Opportunities in the Residential Rental Market

According to data from the US Census Bureau, since 2010, 8.3 million households have been formed, but only 4.9 million homes have been built in that period, which implies that the approximate deficit as of 2019 was around 3.4 million homes in the country. In perspective, this figure is equivalent to 50% of the total housing stock in Chile and in monetary terms about USD 1.181 billion.

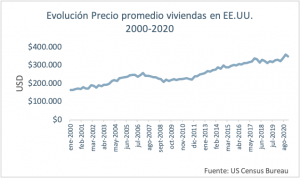

On the other hand, buying a home has become increasingly unaffordable, with prices increasing by more than 60.9% in the last decade[1](see graph 2) and access to financing has become more and more restricted since the 2008 financial crisis.

In addition to this, there have been changes in social behavior, where people are marrying at an older age and millennials, who represent 25% of the total population (75 million people), are less likely to buy a house to live in.

In this context, it is observed that people are opting to rent properties, where since 2009 there has been an increase of approximately 8 million new tenants, reaching 108.5 million people who prefer to rent a home (see graph 3), and it is estimated that by 2025 this figure will reach 115 million tenants1.

The favorable market conditions for the residential rental business make investors prefer to invest in this type of assets, which are presented as an alternative that allows diversifying portfolios, generating stabilized flows and delivering returns with less volatility.

Graph 1:

Graph 2:

Graph 3:

[1] US Census Bureau (2020).