In recent years, the state of Texas has established itself as one of the markets with the greatest investment opportunities in the U.S., especially in real estate. Here converge the size of its population, the growth of the employment rate and a lower cost of living than other parts of the country, which allows it to be a desirable destination for investors.

Texas has a population of nearly 29 million people, which has grown by 14% over the last ten years, a growth of more than 1,000 people per day, increasing exponentially over the last few years. Five of the eleven fastest-growing U.S. cities in the last ten years are cities in the United States. in the last ten years are Texas cities, which, with cultural diversity and many tourist attractions, are positioned as an attractive place to live.

If Texas were a country, it would be the tenth largest economy in the world, with a GDP of USD 1.886 trillion and a GDP per capita of over USD 50,000, which has been growing at an average annual rate of 5% according to IMF data.

The state of Texas has lower mortgage rates than the national average and no income taxThe state of Texas has lower mortgage rates than the national average and no income tax, presenting robust fundamentals to consider it an attractive place to invest in real estate assets. In addition, the state leads the U.S. in job growth, creating new jobs at a rate of 4% per year, which is double the national average.

Texas has a triangular region, known as the Texaplex, made up of the Dallas-Fort Worth, Houston, Austin and San Antonio metropolitan areas, which is home to 75% of the state's population of more than 21 million people. According to the Texas State Demographer's Office, the Texaplex will grow by 2.1 times its actual size over the next 35 years.

Austin

Austin is the capital of the state of Texas. It has the fastest growing population in the entire state, with a 9% increase in the last three years, reaching almost 2 million inhabitants.

It has a GDP per capita of USD 55,420 and in 2019 ranked first in US News &World Report magazine's annual ranking of the best cities to live and work in the US.

Dallas

Dallas is the strategic base for manufacturing and financial industries, which contribute a significant part of the state's GDP. There are more than 10,000 national and international companies headquartered in Dallas, such as Toyota, Amazon, Deloitte, among others.

The area has several universities and colleges, which makes it attractive for rental real estate businesses, considering that most of the university students come from other parts of the country and need a place to live.

Houston

Houston is a dynamic city, leaving behind an economy centered on oil, which today represents only 2.4% of jobs. It has had a 21.6% population growth in the last ten years, reaching over 2.3 million people, making it the fourth most populated city in the U.S. It is also the leading U.S. city in the creation of new jobs.

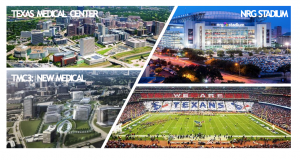

Among the main attributes of this area are the Texas Medical Center, the largest medical center in the world, with more than 100,000 employees and a growth plan of 30% in the next few years. Adjacent to this health center is the NRG Stadium, where the Houston Texans soccer team plays its home games and hosts one of the most important Rodeo fairs in the state.

With a higher quality of life standard, greater employability and tourist/recreational attractions, Texas presents favorable characteristics to invest in real estate.