In recent weeks we have witnessed how the inability to pay of the Chinese company Evergrande has affected the financial market globally, sowing uncertainty and fear among investors, fearful that a bubble will burst again, triggering a global economic crisis like the 2008 Lehman Brothers bankruptcy.

Who is Evergrande?

Evergrande is a Chinese real estate company founded in 1996 and is currently one of the largest companies in the world in terms of revenue, which has allowed it to be part of the Global 500. It is currently the second largest real estate company in China with more than 1,300 projects in about 300 cities throughout China. Its business strategy is very broad and includes, in addition to real estate projects, participation in the construction of amusement parks, electric car factories and it even owns a Chinese first division soccer team.

In recent decades, there has been a boom in the real estate industry in China, a growth that has been largely financed through loans to real estate companies, which, in order to carry out projects, have become indebted to unsustainable levels, as in the case of Evergrande.

Evergrande's liabilities today total more than 300 billion dollars, which is equivalent to three times the public debt of Chile, and represents approximately 2% of the Asian country's GDP, a debt that today threatens its existence and could lead it to bankruptcy.

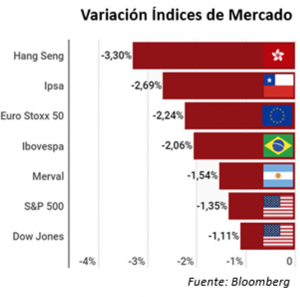

Due to the size of this company and the level of debt it holds, a fear of what could happen in the financial systems has been installed, where experts warn that it could not only occur in China, but could also cause a domino effect throughout the global financial market, and thus unleash a crisis similar to that of 2008 with the real estate bubble that burst in the United States and the subsequent collapse of the Lehman Brothers bank. This fear is further heightened by the fact that among Evergrande's numerous creditors are global financial giants such as BlackRock, UBS and Ashmore.

Due to the size of this company and the level of debt it holds, a fear of what could happen in the financial systems has been installed, where experts warn that it could not only occur in China, but could also cause a domino effect throughout the global financial market, and thus unleash a crisis similar to that of 2008 with the real estate bubble that burst in the United States and the subsequent collapse of the Lehman Brothers bank. This fear is further heightened by the fact that among Evergrande's numerous creditors are global financial giants such as BlackRock, UBS and Ashmore.

Today, all eyes are on how the Chinese government will act in this situation, although in recent days it was announced that the state-owned Shengjing Bank, a commercial bank, will acquire 19.9% of Evergrande's shares for a total amount of approximately USD 1.5 billion, which will reduce the company's liquidity problem.

But, how does the crisis of this world giant affect our country?

The economies hardest hit in South America are expected to be Chile, Peru and Brazil, the latter being less affected due to the diversification of its exports and buyers, since the other two are mono-exporters of raw materials useful for construction, such as copper and iron, and have the Asian country as their main buyer.

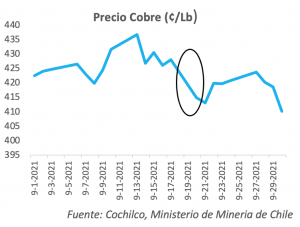

According to the newspaper Financiero, construction activity accounts for 22% of total Chinese demand for copper, so the almost immediate consequence of the uncovering of this situation was a drop in the price of copper of close to 3.07% in value, the largest drop in the last month, since the possible closure of this company puts a significant brake on the purchase of metals for construction, such as copper.

Another industry that was affected by this news was that of iron, a metal whose price fell by 11.5%, dropping below one hundred dollars per ton. In Chile, one of the main companies is CAP, the largest steel producer in the world, and whose main buyer is China, so this fall had an impact on the value of the company, thus affecting the entire Chilean financial market. This was reflected in a rise of the dollar, which experienced an increase of $3.79 pesos on the day of the news of Evergrande's debts, added to the pressures generated by the fourth withdrawal of the pension funds, have pushed the exchange rate above 800 pesos, record levels in recent years.

In the coming days it is expected that the Chinese government will continue to make announcements to somehow solve this problem, which would calm the waters in the financial market, thus allowing to rule out a possible crisis like that of 2008, and restore investors' confidence in the markets, stabilizing the prices of commodities such as copper and iron, strengthening Chile's exchange rate position.