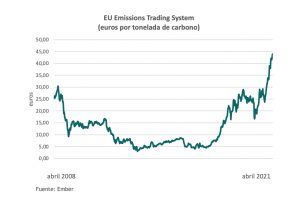

That is the price that some European analysts, such as Casey Dwyer of the oil and energy hedge fund Andurand Capital Management, believe carbon credits traded under the European Emissions Trading Scheme (ETS) could fetch by the end of 2021. Since the beginning of this year the price of carbon credits has almost doubled, reaching around US$50 per tonne in April (Elon Musk, and Tesla's US$518 million turnover in carbon credits in the first quarter, can attest to the better prices). Behind this is the growing interest of investors and greenhouse gas (GHG) emitting companies in this market and the effect of a series of public policies aimed at decarbonizing the economy, both in Europe and the U.S. Other analysts, however, believe that US$100 per ton is an unrealistic projection for the short term due to the impact that such a steep price increase could have on a significant number of companies and the economy in general, leading governments and authorities to intervene to prevent it. The carbon emissions market is a market easily influenced by political decisions.

In any case, the conditions are in place for the carbon price trend to continue to rise: climate change specialists estimate that a ton must be traded at over US$50 to represent a real incentive for companies and economies to adapt and move towards the goal of zero emissions by 2050. Significantly, China, the world's second largest GHG emitter, announced that in June it will launch its own carbon emissions market on the Shanghai Stock Exchange, after years of flirting with the idea.