I have been wanting to start writing in our newsletter for months, but the truth is that I always lack time, the day to day goes over our heads and I leave it for later. However, after reading last week's news about the VAMOS POR EL 100%, I thought it was important to comment on the different pension systems in the world, as a way of contributing to the discussion.

Perhaps you do not remember, but in March 2006 the Marcel Commission was formed and, as if that were not enough, in 2015 the so-called Bravo Commission was formed. This, together with other efforts, shows us the importance that the pension system has had to different governments in our country. In this, many hours of work have been dedicated, incorporating citizen participation, regional dialogues, surveys and much research work.

But... where did it all end?

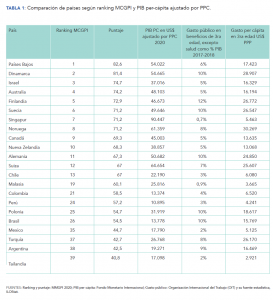

In researching pension systems around the world, I came to the conclusion that the work done is quite consistent with what has been seen in Australia, Norway, Switzerland, Canada, Israel and the Netherlands.

The Marcel Commission mentioned that the Chilean system was not capable of responding to the demands of society, so it was necessary to reform it, which did not mean destroying the current system. The world experience showed that the most successful reforms are based on the individual capitalization system, although it called for structuring a solidarity pillar, raising the replacement rate, increasing the retirement age, universality, intensifying competition, increasing transparency, improving financial education, strengthening the voluntary pillar, implementing a basic solidarity pension (today +- $160,000 Basic Solidarity Pension (PBS) - SP. Superintendencia de Pensiones - Gobierno de Chile (spensiones.cl)) and establish criteria for the sustainability of the system over time. All these concepts, 10 years later, were accepted by the Bravo Commission, which also reached similar conclusions and made 3 proposals, from maintaining the current system to returning to a pay-as-you-go system.[1].

Currently, the best pension system in the world (as ranked by the Mercer CFA Institute Global Pension Index) is that of the Netherlands. It has a universal basic pillar, which works as a pay-as-you-go system, and in which worker contributions are 18.25% (10% in Chile), plus a second occupational pillar, where companies, together with workers, contribute between 4% and 7% of salary to a private pension fund (which can be withdrawn under conditions) and an individual savings fund. With this they hope to reach replacement rates of 70% of their last income before retirement, with a cap of 100%. In addition, there is the Australian system (Age Pension Age Pension - Services Australia ), which has a solidarity pillar (financed through taxes and which can reach USD 1,162 per month), together with another pillar, called Superannuation, which works in the same way as our system. However, it has a small difference and that is that you can opt for more than 85 different funds (for example, you can buy an ESG fund). Finally, it also incorporates a voluntary pillar.

With so much local and international (OECD) experience, I am concerned to see how some politicians have proposed to withdraw the totality of the funds, with the slogan "LET'S GO FOR 100%". I think it would be wiser to reach an agreement (common minimums?) to reduce uncertainty in this area. This should not only be done for the pensions (more than 20 years of studies and why not say waiting), but also for the positive externalities it generates for the economy, where a deep financial system has made it possible for a large part of the population to have access to cheap loans to buy their longed-for house. As an example, I remember that 30 years ago mortgage bills were priced at UF +10% (1990), while today they can be found without problems at UF + 3%, I believe that in terms of welfare the benefits have been much higher. In addition, a deeper capital market opens up more financing possibilities, which allows us all to aspire to entrepreneurship.

[1] Of which I disagree, although, as a result of the 2008 crisis, many Eastern European countries migrated to it.

Francisco Muñoz

Partner - Commercial Director of Fynsa