Venture Capital, or Capital de Riesgo in Spanish, is a type of financing that provides capital to startups in exchange for a smaller percentage of ownership.

These companies are at an early stage of development, where there is a high uncertainty and associated risk, where the name of this type of strategy, but with a high potential for growth and return on investment.

One of the fundamental pillars of Venture Capital is the impact that these investments generate in society, where in addition to providing financing options to many companies, they have an impact on the economies of different countries. According to a study by Oxford Economics, for every dollar invested in VC, 7 dollars remain in the economy of that country.

How is it different from Private Equity?

These strategies differ mainly in the percentage of ownership of the company that each one acquires, on the one hand, in Private Equity funds the investor takes control of the company, where he/she bets to make it grow and mature and then sell it. On the other hand, Venture Capital funds acquire smaller percentages of ownership in companies that are still in the development stage, where the bet is to sell when the company begins to mature.

The VC fund industry

In the world, Venture Capital oriented funds have been gaining prominence, where according to Preqin data, there are currently 2,469 VC funds with an AUM of more than USD 200 Bn, which increased by 21% over the last year.

The average return of Venture Capital funds globally is around 18% per annum over the last year and 12.5% per annum over the last five years.

In Latin America, VC funds have experienced explosive growth over the last three years, where they have doubled the capital invested in this type of funds, reaching a total of USD 4.1 Bn by 2020.

This growth is largely due to the number of successful cases in this part of the world, with 26 companies that have achieved the category of unicorns (which are valued at more than USD 1,000 MM) and there are 240 that are classified as "Centaurs", which to date are valued at more than USD 100 MM and are expected to achieve in the short term the category of unicorn, so that the region has gained prominence and is considered an area of investment opportunities in startups.

Where is Chile?

In Chile, there are currently no public VC investment funds, there are 48 funds in force that are all private, which receive a great deal of support from CORFO.

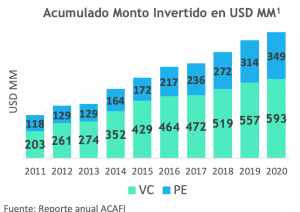

Investment in this type of strategy has been steadily rising, reaching a total invested amount as of 2020 of USD 593 M, an amount that has increased by 6% over 2019 and 68% over the last five years.

As mentioned above, CORFO has been a fundamental pillar in the development of this type of investment, providing support and financing, which has reached USD 349 million invested in this type of fund.

As mentioned above, CORFO has been a fundamental pillar in the development of this type of investment, providing support and financing, which has reached USD 349 million invested in this type of fund.

There are 374 Chilean companies that have benefited from this type of investment, where the category that has grown the most are those related to information technologies with 50% and FINTECH with a total of 20%.

There have been several success stories in Chile, among which three companies that achieved the category of unicorns stand out: Crystal Lagoons, Cornershop and Orca Bio, but there are many more with the category of centaurs and that are expected to become unicorns in a short time more, among these stand out Fintual, NotCo, Betterfly, Poliglota, Protera and PhageLab.

Venture capital is positioned as an attractive investment alternative, with expected returns over other alternatives and shorter terms. In Chile, there have been several successful cases, which shows that there are many companies and ideas, which do not reach port due to lack of financing, an issue that could be solved through Venture capital investment funds that participate in these companies, in order to achieve success together and to consolidate this investment strategy in the country.