If you are a regular reader of our newsletter you may have noticed that our strategy notes have been focused in recent times on international markets, which is no coincidence, since our objective has been to promote the wide range of investment alternatives and opportunities, in addition to the advice we have available to our clients in those markets.

This does not mean that we have neglected our local proposals, but we understand that, given the lack of visibility and the increased volatility of local assets, it is our responsibility to promote a more comprehensive, diversified and global approach to investment management.

That said, we believe it may be a good time to re-evaluate opportunities in local markets, we believe it may be a good time to re-evaluate opportunities in the local markets

The first presidential round left us with some "surprises". The fact that Kast and Boric made it to the second round was the consensual result of the first round and the one that practically all polls showed. However, the near 2% advantage that Kast obtained was less consensual and is one of the reasons why the market took it positively, as it gives him an additional impulse to start the second round race (something that will probably be reaffirmed in the first polls).

The main surprise in the presidential election was the fact that Parisi came in third place, defeating both Sichel and Provoste, the candidates of the traditional political coalitions. While it is difficult to identify Parisi within the political spectrum, his voters now become key to defining the winner in the second round.

In principle, Parisi's main initiatives have a greater similarity with Kast than with Boric, including as examples, migration issues, his proposal to generate efficiencies in public spending in order to redirect resources to pensions, health and education, his idea of lowering corporate tax and differentiating it according to the size of the company, or the fact that despite greater regulation he believes in the private pension system based on individual capitalization accounts. That said, the "transfer of votes" has never been linear in past elections and, consequently, it will be very important to monitor in the coming weeks where these voters are going.

However, in more aggregate terms, we believe that the main positive surprises came from the legislative elections, with the center-right gaining significant ground and reaching 50% of the Senate. One of the main questions prior to the elections was whether the center-right could retain one-third of the seats in both chambers. The May 2021 elections of mayors, governors and constituents had implied a strong setback in terms of representation for the government coalition. However, this time the result was the opposite, with the center-right gaining ground, obtaining 50% of the seats in the Senate and 44.5% of the seats in the lower house. In the latter case, not including the 3.9% obtained by the People's Party.

Having a balanced congress is very important, and even more so in this context, since any change to the rules that determine the work of the constitutional convention requires two thirds in Congress (a constitutional reform) to be approved. As a sign, a greater representation of the center-right is also positive, leading to a balance of forces within the congress also thinking about the future government.

What's next? Likely moderation to seek the center. We believe that the market will welcome this moderation, as it could reduce uncertainty going forward. Signs in this sense have been perceived during the week, for example, in the adjustment of the economic teams of both candidates, although for the moment without very concrete proposals that would allow us to draw further conclusions.

Let's go to the strategy

How should the market react? Initially the reaction was quite positive, although it has been diluted over the days, also explained by a less friendly international environment. But beyond short-term volatility, we believe that the market should interpret these results positively, and it is justified in doing so. The confirmation of a Kast-Boric runoff eliminates some of the tail risks that were embedded in the election (such as not having right-wing candidates in the second round, for example), while the results of the parliamentary election (the biggest positive surprise), is positive not only as a political sign, but also because it would probably moderate the actions of the other two forces that will coexist going forward: the Executive and the Constitutional Convention.

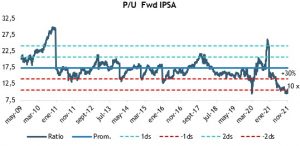

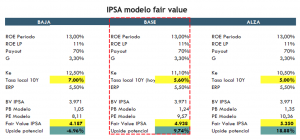

This new scenario should trigger a new rating for Chilean equities. It should be understood that Chilean equities carry a significant "institutional political risk premium" that has us currently trading at highly discounted valuations, with their 12M fwd P/U at around 10x and their P/BV ratio at 1.2x. These figures compare to 10-year historical averages of 16.9x and 1.74x, respectively. While we do not believe the market will return to those levels of multiples, a re-rating to the midpoint of historical averages (-1ds), would imply a 30%+ return based on both multiples.

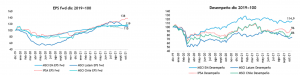

Otherwise, we are with good corporate visibility (with reasonable doubts going into 2022). IPSA is on track to show 20%+ earnings growth from the end of 2019 (vs. 15% EM), while we have 30% lower profitability.

For now we prefer to remain conservative in the target multiple, because we believe that somehow the market, in the absence of "long term visibility", has been dedicated to valuing the "day to day" depending on how interest rates move. In that sense, a sovereign rate at current levels (today at 5.6% for 10 years), is already consistent with an IPSA at levels closer to 5,000 points (which is in practice what the market priced before the corrections in recent days), while a rate around 5.0% (levels that we consider more fair value), should be consistent with a rise of almost 20% in the IPSA, for our bullish case (considering current levels at around 4,500 points).

Investment downturn

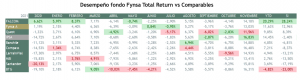

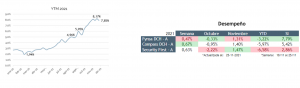

Today we have 2 financial funds in FYNSA with which we can expose ourselves to the above scenario:

In local equities the Fynsa Total Return Fund and in local fixed income the Fynsa Deuda Chile fund.

While the ultimate direction of the market will ultimately be determined by the outcome of the second round, near-term market improvement is likely to be driven by improved sentiment.

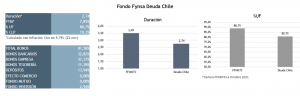

In local fixed income, prime rates would have room to adjust by at least an additional 50 bps, especially in the longest part of the curve, also considering the retracement of the fourth withdrawal of pension funds, so that the performance of local fixed income should extend the improvements already seen in previous weeks. In this sense, the Fynsa Chile debt fund currently offers an attractive risk-return ratio.

Humberto Mora

Strategy and Investments