2021 was a record year for venture capital in Latin America, never before had so many deals been made, so much capital raised and so many companies achieved market capitalization of over US$1 billion, thus becoming unicorns.

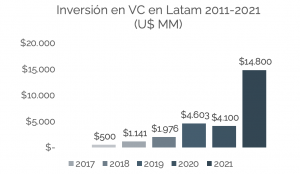

According to PitchBook data, it is estimated that by 2021, US$ 14.8 billion will be invested in Latin America, more than tripling the investment made in 2020 and almost doubling the number of deals. In terms of market valuation, 15 companies managed to become unicorns, among them Cornershop and NotCo. Thus, the region currently has 40 unicorns, 38% of which were created last year.

Until 2017 the Venture Capital industry was quite more precarious than it is today, that year investment doubled compared to 2016. This started to attract the attention of foreign investors. SoftBank a Japanese investment bank started its 2019 investments in Latin America, when its COO; Marcelo Claure and Bolivian entrepreneur, realized that the bank had investments for $USD 100bn in Southeast Asia, but none in Latin America, which had the same population, but double the GDP. At that time SoftBank decided to launch the Latin American Fund with a size of $USD 5 billion and around 60 startups in its portfolio, a huge bet on the region, impressed by the talent of Latin American entrepreneurs.

From then on, SoftBank would invest in 15 unicorns in the region, such as Rappi and perhaps future unicorns such as Chile's Betterfly. This has allowed the fund to have a cumulative net return of 85% in dollars since they started investing in 2019 according to what the bank publishes. SoftBank would not be the only one, Sequoia Capital, the world's largest VC in number of deals according to Preqin and investor in world-class startups such as Airbnb, would invest in Nubank, Fintual and Rappi.

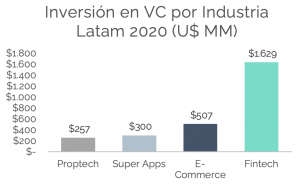

Fintechs, companies that apply technology to the financial industry, continue to reign among the startups that receive the most funding both in Latin America and globally. During 2020; according to the Association for Private Capital Investment in Latin America (LAVCA), 40% of Venture Capital investments were made to companies in this area, followed far behind by E-Commerce. By mid-year 2021, LAVCA reported that the trend continued, with 42% of Venture Capital investment going to Fintechs.

According to LAVCA's mid-year report, Brazil is in first place among the VCs' favorite countries, accounting for more than half of the deals and total investment. Mexico is in second place, taking 20% of the investment in Latam, going from 0 unicorns to 7. Finally, Colombia closes the third place of the podium with 10% of the investment in Latam.

To conclude, 2021 was an excellent year for the Venture Capital industry in Latam and according to what Preqin publishes it is expected to maintain its steady growth shown during the last years and with many more companies looking to become the next unicorns.

AGF Team