Markets continue to operate volatile and without a driver that can take them out of the recent weakness, at least for the short term. On the one hand, there is pressure from geopolitical risks in Ukraine which, of course, generates uncertainty due to the disruptive effects of a military escalation (which is not our base case), and on the other hand, concerns persist about the process of monetary normalization by the US Federal Reserve, where the market (and us) has been leaning towards faster and more aggressive rate hikes given the higher inflationary risks.

In some ways both events feed back on each other. Rising geopolitical tensions lead investors to be more cautious about the prospects for aggressive Fed action to address inflation. Immediately following last week's very strong US CPI report (+7.5% y/y), fed funds futures basically fully priced in a 50bp move in March. But since the Ukraine situation escalated last Friday, that has receded almost continuously, and futures see only a 38% chance of a 50bp move next month. Now, if the geopolitical risks recede those odds will rise again, leaving the market basically "trapped" and this will continue at least until mid-March when the Fed will finally have to "transparent" its rate and inflation scenario going forward.

But let's get to today's convening... Last week we argued that we believed we are at an inflection point of some major structural changes. The post-pandemic cycle is driving higher inflation and interest rates(Coming to terms with the new reality: Strategies for a positive interest rate world).

And that as we move through this inflection point, the drivers of returns and market leadership should be very different from the last cycle and should result in a different approach to investment strategy. To wit:

In particular, the last two points seem to us to be key in terms of positioning for the future.

Citi Research recently published an interesting study that addresses these trends from the investment flows, whose conclusions support our main convictions regarding Asset Allocation for 2022, i.e.: OW in equities, UW in fixed income, and OW in commodities and ex-US markets.

Basically the study concludes that there are 3 rotations in progress

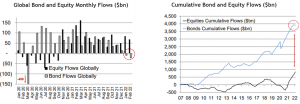

Rotation #1: Bonds to equities: global bond funds are on track for two consecutive months of outflows (-US$32 billion YTD), while equity funds have recorded inflows of US$153 billion. These are significant movements, but remain small in historical context. Looking at cumulative flows since 2007, there is still a US$3 trillion gap between bonds and stocks. Perhaps more of that money could flow back into equities in the face of any further price declines. We are favoring a very conservative strategy in terms of duration and credit risk.

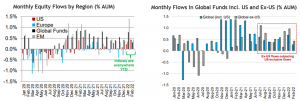

Rotation #2: from the U.S. to the rest of the world: equity inflows have been solid across geographies this year. However, investors are starting to show a preference for cheaper markets outside the U.S. For example, flows into global funds outside the U.S. have outperformed funds that include the U.S. for seven of the past eight months, as a percentage of AUM. For those looking to diversify outside the US, we are overweight Emerging Markets, Europe (primarily UK) and Japan.

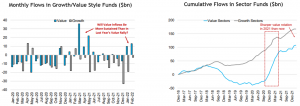

Rotation #3: growth to value: in line with this year's price action, value funds have seen strong inflows relative to growth. However, this still seems small compared to the 1Q21 value rotation. Looking at Value style funds, inflows peaked at around $70 billion last year, but have only seen $20 billion of inflows year to date. Although the 1Q21 churn fizzled out quickly, we suspect its 1Q22 counterpart could extend further. We are overweight financials, energy and commodities in general.

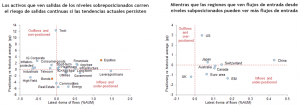

Finally, the positioning and flow of funds backdrop looks negative for inflation-protected bond funds, investment grade corporate bonds and certain equity sectors in particular growth sectors (technology): these market segments are over-weighted (relative to history) and losing flows. The fund flow outlook may be more positive for European and emerging market equities as well as energy equities: these market segments are under-positioned (relative to history) and accumulating flows.

Humberto Mora

Strategy and Investments