The first quarter of 2022 was not a good period for mergers and acquisitions. According to a report from S&P Global, in the first three months of this year the amount of transactions fell by almost one-third compared to the first quarter of 2021 versus the first quarter of 2021, accumulating only US$691.5 billion. The so-called megadealsof more than US$5 billion fell sharply, from US$417 billion to US$284 billion. Inflationary fears and the Russian invasion of Ukraine are two of the main factors behind the drop, according to S&P Global.according to S&P Global.

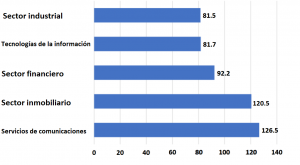

The sectors that stood out in the first three months of 2022 were communications serviceswith transactions of US$126.5 billion; and real estate, with transactions of US$126.5 billion. real estate sectorwith US$120.5 billion. In the first quarter of 2021 the financial and real estate sectors had dominated and the information technology.

By geographic areaBy geographic area, most of the operations were carried out in the U.S. and Canada. USA and Canadafollowed far behind by Europe. Europe. At Latin America and the Caribbean accounted for US$12.4 billion in transactions in the first quarter of 2022, 34% less than in the same period of 2021. in transactions in the first quarter of 2022, 34% less than in the same period of 2021.

Source: S&P Global

Source: S&P Global