Recent price action in sovereign debt markets is confusing on several levels. Yield curves globally have flattened significantly.

Some possible explanations for the recent price action include:

1) concerns about the delta variant are a headwind for prospects, particularly for regions with low vaccination rates.

2) the growing risks of a more aggressive Fed,

3) fading fiscal optimism, particularly in the U.S.; and

4) fears of a possible slowdown in China driven by the adoption of a more relaxed stance by policy makers.

None of these are particularly satisfactory explanations, in our opinion, as we have pointed out in previous newsletters.

First, while the delta variant has led to an increase in new cases in many regions, hospitalizations and deaths remain low in areas with high vaccination rates. As a result, we believe the economic impact for the U.S., Europe (and China) will be limited, although some parts of the world could suffer a larger impact on growth.

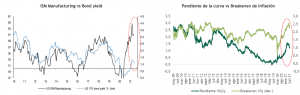

Second, while, in principle, an aggressive Fed should flatten the curve, the speed and low levels at which the curve flattening is occurring suggest that markets are placing too much weight on scenarios in which the economy cannot handle even a modest degree of policy tightening.

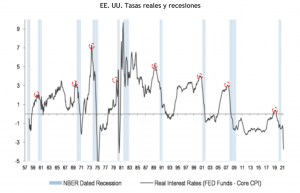

Otherwise, we believe monetary policy will remain supportive, rates in real terms will remain extraordinarily expansionary, as will financial conditions.

Third, while there have been delays with additional fiscal expenditures, the impact of the expected infrastructure initiatives is not as great in the context of the measures that have already been approved, the impact of the expected infrastructure initiatives is not as great in the context of the measures that have already been approved.

Fourth, while a slowdown in external growth could certainly drive U.S. yields lower, we have noted that fears of a deeper slowdown, particularly in China, appear to be overblown, we have pointed out that fears of a deeper slowdown, particularly in China, appear to be overblown.

However, recent declines in long rates are framed by the market's perception of a slowdown in growth and a declining inflationary threat, a thesis we do not share. We believe that long rates are on the downside of this corrective process. We continue to target levels closer to 2% for the 10-year treasury by the end of 2021 and with a yield curve that will start to steepen again. Consequently, we recommend a conservative strategy in terms of duration in international fixed income.