- At the beginning of a complex year for risk assets, the IPSA managed to stand out from global markets affected by expectations of rate hikes by the FED and the recent global geopolitical conflict. The higher performance of the IPSA is mainly explained by the strength of commodities and its "more value" composition (see attached table), a characteristic that is shared by the rest of the region's stock markets, which added to the attractive interest rate differentials has favored greater investment flows to the region.

Growth: Consumer Discretionary, Information Technology, Communication Services, Health Care (more "long duration and therefore more sensitive to higher interest rates)

* Value: Energy, Materials, Financials, Industrials (more indexed to the "real economy, sensitive to higher inflation, "short on duration" and therefore less sensitive to higher interest rates)

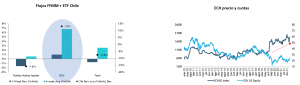

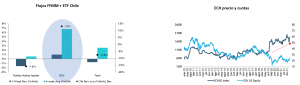

- In fact, foreign investors have been the big buyers of local stocks in recent months. ECH (the ETF that replicates the MSCI Chile) quota creations are at all-time highs.

- Thus, while global equities fell 5.2% in the first quarter, the IPSA's performance was +24.5% measured in dollars, very close to the performance of the rest of the region.

- Sectors related to local activity and higher inflationary dynamics such as banks (+24% ytd) and the commodities sector (+44% ytd) stand out given the positive outlook for most of the local underlyings (Iron, Lithium, Cellulose). Both sectors today represent almost 60% of the IPSA.

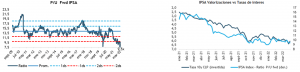

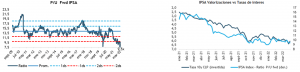

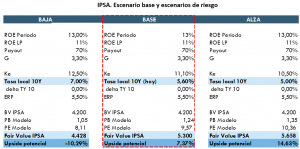

- Despite the IPSA's outstanding performance so far in 2022, in contrast to global equities, we see room for further recoveries in a context of valuations that remain attractive in a long-term context both in absolute terms and Latam comparable . Although the domestic scenario will continue to be complex due to the political and institutional challenges we face in the coming months, the external scenario offers some compensation, given the attractive prices of copper and raw materials in general (iron, cellulose, lithium) .

- The geopolitical escalation has greatly increased the risk of further aggravating the energy and commodities crisis that developed over the past two years. Potential disruptions to trade in oil, gas, grains and metals now represent a significant risk to investments and the real economy. Investors should therefore hedge this risk by increasing allocations to commodities, energy and materials. These allocations would serve as a hedge for inflation and geopolitical risks.

- The "more moderate" tone set by the Central Bank regarding the future path of the monetary policy rate has translated into a sharp adjustment of market rates in recent days, which should take pressure off widely discounted valuations and allow for some expansion of multiples in the short term.

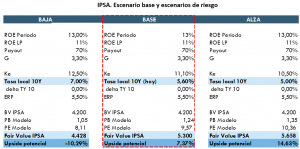

- However, in a still conservative scenario we are adjusting slightly upwards our projection for the IPSA to 5,300 points (+7.5%) and +15% in our more optimistic case (5,650 points). This adjustment is justified in a context of still upward revisions in expected earnings for 2022 (+15% only during the month of March) and lower interest rate pressures, due to the more moderate tone set this week for interest rates by the Central Bank.

- We favor selectivity in stocks that we find undervalued (value), of quality (solid financial position), and growth potential. Sectorially we are favoring the commodities, banks and consumer sectors.

Investment downturn

Our Fynsa Total Return Fund provides exposure to local equities through an active, high conviction strategy that maximizes Alpha generation. For more details see HERE

Humberto Mora Deputy Investment Manager