There are several perceived headwinds in weaker global growth, inflation concerns, rising input costs, peak profit margins, the Fed's policy shift and recently concerns about China's credit markets.

But let's take it one step at a time.

How concerned should investors be about Evergrande's problem?

To begin with, it is good to do a little history:

Now, while China could carefully manage any potential default or restructuring of Evergrande to protect the financial and real estate markets, it may need to do more. Economic data is already weak and a clear message from the government is needed to shore up confidence and stop the domino effect. The absence of such action poses a significant downside risk to growth going forward.

In summary, we do not believe the sector faces systemic risks; over-leveraged developers will gradually sell their assets with central and local government support when necessary.

In another relevant milestone, the Fed strongly hinted that they will begin tapering asset purchases after the next FOMC meeting in early November. The statement following this week's meeting indicated that if economic progress "continues broadly as expected," then a slowdown in the pace of purchases "may soon be warranted."

The tapering signal was widely expected, given the strong indications from previous statements. While there is some conditionality attached to the November tapering decision, Powell made it clear that it would take a major disappointment to throw them off course.

But Powell went a step further by noting that "a gradual tapering process concluding by the middle of next year is likely to be appropriate." This assumes a per-meeting reduction in the monthly purchase pace of US$10 bn for Treasuries and US$5 bn for MBS.

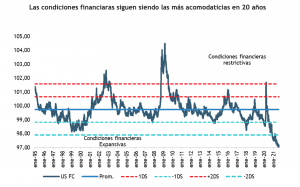

Regardless of how the story finally ends and barring any major inflationary surprises, things continue to point to a very gradual normalization that would keep financial conditions fairly accommodative and despite concerns about the recent downward shift in economic data, we remain confident that strong growth is ahead and activity is set to accelerate again. We believe the recent slowdown is temporary and driven primarily by the delta wave.

We do not expect a permanent destruction of demand from this wave of Covid, but rather a delay in reopening and economic normalization. In fact, a growing number of indicators point to an inflection in the Delta variant. While Covid continues to decline, the strong momentum should continue into 2022 as companies begin to rebuild depleted inventories and increase capital spending. Central bank policies should remain growth-oriented, and even China's slowdown will likely be countered soon with a policy turnaround.

Against this backdrop, risk assets would continue to do well and bond yields appear to be finding a floor, which generally bodes well for cyclical value leadership.

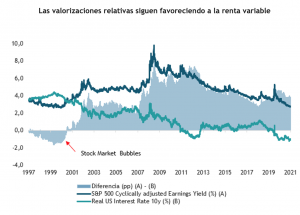

A final thought. We see a lot of emphasis on high equity valuations, but less talk about the unattractiveness of corporate prime rates and spreads with little room to compress.

In this regard, we believe the correct approach is to continue to overweight equities over fixed income, where relative valuations continue to offer a large premium to their history, while for fixed income we recommend a conservative approach in terms of duration.

Investors should note that the Fed is moving forward because it has more confidence in the economy and will continue to provide support. While higher bond yields reduce the relative attractiveness of stocks, a gradual rise in bond yields should be more than offset by the positive impact of rising corporate earnings as economies return to normalcy. Therefore, the Fed tapering should be viewed as the gradual withdrawal of an emergency support measure as conditions normalize.