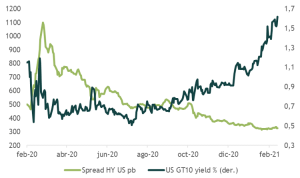

Many market participants were concerned that a large and rapid move in prime rates would cause spreads to widen. Despite strong empirical evidence that growth-driven rate settlements do not normally lead to wider spreads, the concern was that today's ultra-low absolute level of yields makes higher rates harder to digest. So far, these concerns have proven to be overblown (see attached charts).

While it is expected that rates may go a bit higher through the end of the year, if the combination of the increase is equal parts real yields and breakeven inflation, it should not be a major problem for credit spreads.

Spread IG US vs. US GT10 yield % Spread IG US vs US GT10 yield % Spread IG US vs.

Spread HY US vs US GT10 yield % HY US vs US GT10 yield % Spread HY US vs US GT10 yield