Hopes that vaccination could end the coronavirus pandemic are driving two parallel rotations in the U.S. stock market.

First, the prospect of a return to economic normalcy is lifting stocks in "Covid loser" sectors at the expense of "Covid winners" that prospered during the pandemic. As a result, oil and gas, retail REITs, airlines, hotels and resorts and the like are now outperforming technology hardware, online retailers and gold.

Second, the expectation of higher rates as growth prospects are boosted by the vaccine rollout and sustained monetary and fiscal stimulus is lifting "value" stocks that are cheap relative to current earnings and thus may be considered short-lived. Meanwhile, "growth" stocks that are expensive relative to current earnings and are therefore long-lived are struggling on a relative basis. In this environment, the financial sector can provide a hedge against a sharp rise in long rates and the commodity sector against rising inflation expectations.

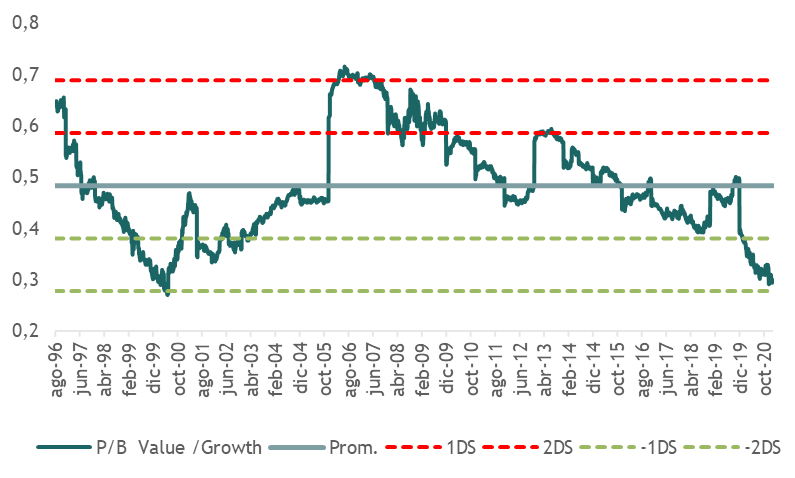

Relative valuations between value and growth are still close to 20-year lows.

Relative valuation Value / Growth

Relative performance Value / Growth vs Interest rates