Year-to-date, the MSCI EMU index has posted a total return of 15% in dollar terms. The MSCI U.S. has managed just 12%. Go back to early November, when hopes for Covid vaccines began to boost markets, and the performance differential is even more pronounced. Eurozone equities have returned 44%, compared to 31% for U.S. equities. The Eurozone has outperformed despite starting later to vaccinate and having a slower start to its vaccination programs. The consequence of these delays is that European countries are only now beginning to ease their restrictions on economic activity. This suggests that eurozone growth has room to surprise on the upside, and that eurozone stocks can still generate further gains.

As vaccination programs have accelerated and service industries have begun to reopen, opinion polls have rebounded.. Data released this week showed that France's business confidence index rose to its highest level in three years in May, with service sector confidence rising. Similarly, Germany's IFO survey of business expectations showed its strongest reading since January 2011.

As a result, the European Commission's recently updated forecast for annual eurozone growth of 4.3% seems too conservative. A figure above 4.5% seems more likely, and possibly as high as 5%.

This suggests that further upside is still likely for the cyclical plays that have led the recent rally: Covid's former "losers," including banks and traditional retailers.

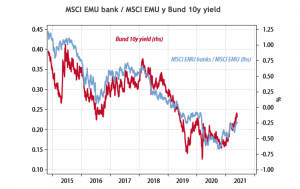

With a total dollar return of 99% since the end of October 2020, eurozone banks have surely already seen the best of their run. However, there is good reason to believe that they can still offer some additional upside.

Traditionally, the performance of Eurozone banking stocks relative to the broader index has been highly correlated with the slope of the yield curve. With the European Central Bank pledging to keep policy rates unchanged until inflation is "consistently" on target, the short end of the curve will remain anchored in negative territory well into the medium term. As a result, the slope of the curve, and thus the relative performance of bank stocks, will be determined by movements in 10-year rate yields that have upside risk.

Among the other "Covid losers" likely to continue to outperform are traditional retailers. Hard hit in the early days of the pandemic, they have recently recovered ground at the expense of online retailers. So far this year, traditional retail stocks are up 15%, while online retail stocks are down -7% on average. This trend is likely to continue as European economies reopen.

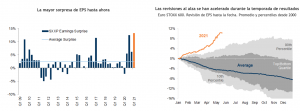

Finally, corporate earnings visibility has been improving dramatically in Europe, with the 1Q21 results far exceeding estimates (see charts).