We invite you to review some of Fynsa Total Return's main milestones during this period:

Below is a summary of the fund's performance since its inception:

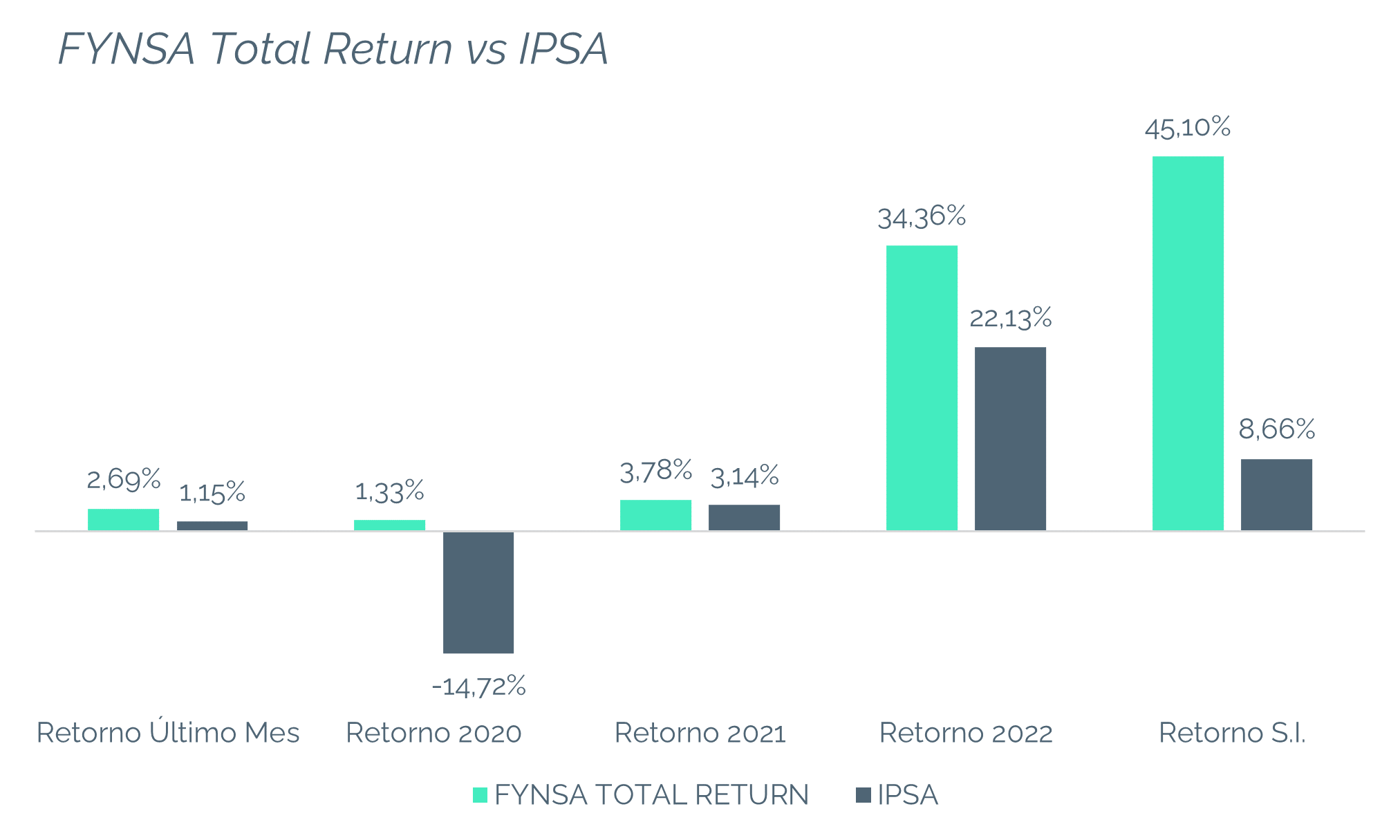

Starting this 2023, the fund has once again managed to stand out from its competitors, obtaining at the end of January a return of 2.69%. 2,69%generating an excess return of 1.54% over the IPSA over the same period.

Since Inceptionon January 9, 2020, as of the end of January, the fund has a return of 45,1%, placing it as one of the two best-performing local equity funds during that period, and far outperforming the IPSA, generating an excess return of 36.44%.

During 2020, the fund had a return of 1,33%, which, in retrospect, is a great performance, as it was among the strategy's two best-performing funds. two best-performing funds in the strategy of that year out of 40 comparables, and returned 16.06% over the index in that period.

At 2021the fund once again had a more than outstanding performance, with a 3,78% 3.78% return, again outperforming the IPSA (+0.64%), and placing it in the top 5 of the top 5 of the strategy's funds that year in terms of performance.

Finally, during 2022the fund had an outstanding performance, demonstrating its good performance and consistency with a 34,36% return, once again outperforming the index with an excess of 12.23%, and once again finding a place within the top 5 of competing funds.

"The Fund's strategy has shown consistency in these first three years of history, in an extremely dynamic market scenario. According to our analysis, the Chilean market is one of the few globally in a position to expand multiples in a high interest rate scenario. In our first three years of track record, the Fund has been able to outperform the market in all rolling twelve-month periods."

Jose Joaquin Prieto, Investment Manager.