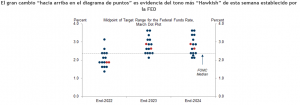

The FOMC raised rates for the first time since the pandemic began and delivered a consistently hawkish message at its March meeting. The midpoint rose more than expected to show seven rate hikes in 2022 and a terminal rate above neutral at 2.75%.

Nearly half (7 out of 16) of the Committee participants are looking for more than seven hikes this year, a fact that was also highlighted by Chairman Powell; this adds credibility to the idea that at least a 50bp hike is a real possibility later this year .

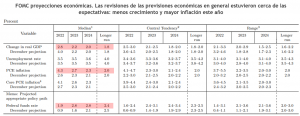

On the economic front, Chairman Powell reinforced the hawkish tone by acknowledging the severity of the inflation situation in his press conference and emphasizing the strength of the economy and the labor market in particular, comments that suggest it would take a lot to pull the FOMC off its tightening path.

Powell said the FOMC will be "mindful of the risks of further upward pressure on inflation and inflation expectations" and acknowledged that high inflation has spread more broadly in the services sector and that wage growth is running at a pace well above what would be consistent with 2% inflation.

Powell also assessed the risk of recession as "not particularly elevated," and emphasized that the 2022 average GDP growth forecast of 2.8% is 1 percentage point above long-term potential, highlighted the "tremendous momentum" in hiring, and pointed to the gap between jobs and workers as evidence that the labor market is "extremely tight.

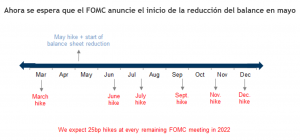

Regarding balance sheet reduction now the FOMC is expected to announce its start at its next meeting in May, according to Powell's own suggestion and he also noted that the minutes of this week's meeting, to be released in three weeks, will reveal some of the key parameters of that process, and that it will be faster than the last cycle, but will otherwise look "very familiar." This suggests a pace of US$60bn per month for Treasury securities and US$40bn per month for mortgage-backed securities, similar to last time, but at a faster pace.

Market scope and investment recommendation

Balancing the negatives (tighter policies and high valuations) with the positives (low recession risk), investors are advised to maintain a more or less neutral risk exposure. Given valuations and the prospect of rising yields they should keep fixed income duration low and favor value over growth stocks and overweight banks and the energy and commodities sector in general.

Humberto Mora

Strategy and Investments