Lately, we have been hearing constantly in the media about a possible recession and inflation that is being possible recession and inflation that is proving difficult for the world's major powers to control.. But the question is how this affects us and how we can protect ourselves against these scenarios in terms of investments.

One of the most traditional ways to combat inflation has always been to raise interest rates, which has direct consequences on the increase in the cost of living and the fall in the price of stocks, bonds and all kinds of assets.

Despite the well-known consequences, The United States has shown us a type of investment that has not been affected in periods of interest rate hikes and has proven to be extremely resilient in turbulent times, called private debt, and in particular that debt that incorporates as interest rate the floating rate known as the floating rate (floating rate).

Before getting into private debt itself, it is critical to clarify that private debt is part of a market distinct from the already known High Yield Bonds y Syndicated Loan Banksbecause its structure is oriented to finance middle market companies in the USA. The main advantage of private debt investments is that, being debt, they have a higher priority of payment than equity (lower risk and return).. In turn, within the types of debt we can find different categories and payment priorities, which typically consist of senior, mezzanine and subordinated.

The main characteristics of private debt are that it is an investment instrument widely used in the SME markets (Small and Medium Enterprises).Small and Medium Enterprises) and, secondly, that are issued at floating rate. Consequently, private debt is made or formed for SMEs based on their cash flows and securitized by senior debt in their capital structure.

What does this mean? It means that the cash coupons on this private debt reset more frequently as rates rise (every 30 or 90 days) and that they, in turn, have shorter maturities than corporate bonds (corporate bonds have a duration of 5-7 years, while EMS bonds have a duration of 2-4 years). (corporate bonds have a duration of 5-7 years, while EMS bonds have a duration of 2-4 years).

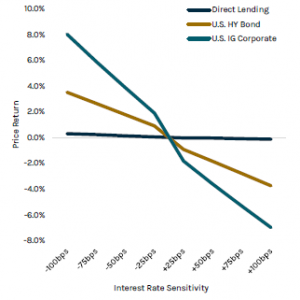

With shorter duration and floating rates that are updated every 30 days, the result is that private debt performs more stably than High Yield Bonds and Syndicated Loan Banks, because returns grow in the face of rising rates through the same floating rates. private debt has more stable performance than High Yield Bond and Syndicated Loan Banks, because returns grow in the face of rising rates through the same floating rates. Another factor affecting performance is the fact that senior debt has covenants that provide greater structural protection than corporate bonds.

If you want to continue investing in a safer way, but at the same time obtain good returns, private debt may be the best tool in the current scenario, given its floating rate structure and SME orientation.

Diego Covarrubias

AGF Team

1 Private Credit: Differentiated performance in the midst of rising interest rates. Acres Capital Management