There are already several calls for a new commodity super cycle. The fight against climate change will have a positive impact as metals are required to build the necessary infrastructure in energy, batteries, EVs and there will be less supply of crude oil. China's growth, expansionary monetary policies, dollar weakness, inflation are other drivers. Commodities have had 4 super cycles in the last 100 years. The last one occurred in 2008 (peak) after 12 years of expansion.

Otherwise, commodities have higher correlations with inflation surprises than other asset classes, making them good inflation hedges.

In particular, the market has become more optimistic about the trajectory of copper prices, with projections pointing to an average of US$10,000 /t (US$4.5 /lb):

Many of the upside forecasts are based on a deep deficit during 2021 and low inventories in the coming years. Citi projects a 500,000 tn deficit for 2021, while Goldman Sachs forecasts a deficit of around 330,000 tn.

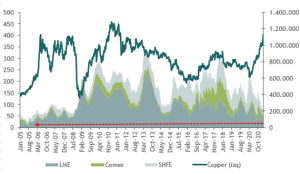

This would lead to low copper inventories in the coming years. Indeed, copper inventories are at 15-year lows, and have fallen by 40% so far in 2021 alone (see attached chart).

Copper vs. inventories