In a changing market, where the outlook for the future is uncertain, the need for financing is becoming increasingly difficult, more costly and less flexible, which reduces the tangible benefits for companies.

The word "mezzanine" (from the Italian "mezzanino") means the intermediate level between one floor of a building and another, which graphically describes this type of investment as it is a hybrid strategy between debt and equity. Mezzanine debt is a strategy that obtains a return similar to that which equity would seek, but in terms of payment structure, it takes precedence over shareholders. It is for this reason that it is considered a hybrid strategy.

To better understand this, companies have several financing options, where at the extremes in terms of cost are senior debt, which refers to traditional bank debt acquired at a lower cost and which has the highest priority of payment at the time of liquidation. At the other extreme, there is equity financing, which is more expensive given the profitability demanded by investors and riskier as it has the last priority of payment at the time of liquidations.

In the middle ground between these options is mezzanine debt, which allows for greater flexibility and customization depending on the type of business. "There are three types of mezzanine, senior subordinated debt, convertible subordinated debt and preferred stock, all these instruments have priority in case of bankruptcy." (Eric Novinson, 2014)

In this context, mezzanine debt presents a series of advantages and benefits for companies and their shareholders, since it has more flexible payment characteristics that allow it to adapt to the needs of the business, such as deferring interest payments, paying lower interest in exchange for a percentage of profits, and also this alternative is not dilutive, so it allows maintaining the equity portion to shareholders. When this type of financing is combined with traditional debt, it reduces the need for capital on the part of the shareholders, which improves their return, allows them to protect themselves and not slow down growth in times of lack of liquidity.

The most commonly used form of mezzanine is subordinated debt, which consists of the mezzanine lender sharing collateral with the senior debt (e.g. Bank), in a subordinated portion, which means that the mezzanine lender takes a second guarantee, this makes it riskier and therefore requires a higher return, where in case of default the mezzanine lender has the option to convert the debt into equity to protect its investment.

Other forms of mezzanine are convertible loans in which the lender's return is related to the company's profits. There are also convertible bonds, which in addition to receiving interest and amortization have the right to acquire shares in a certain period of time.

Global trends and local opportunities

Globally, Mezzanine debt-related investment funds have seen the largest increase in AUM in recent years, where according to Preqin data, they rank third in AUM among private debt strategies.

On the other hand, the study prepared by Preqin and its database of investment funds worldwide, places mezzanine debt as the strategy with the best risk-return ratio in private debt funds, where with an average standard deviation of around 6%, it offers average returns of 9.8% (see chart).

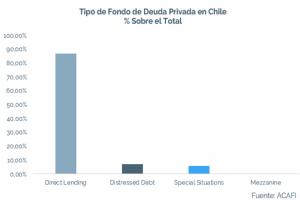

At the local level, this strategy is underdeveloped, with less than 2% of the public private debt investment fund portfolio. In the current scenario of uncertainty and rising interest rates, mezzanine debt appears as a concrete business opportunity, which could satisfy the needs of both investors and companies that require financing.