The market has become very optimistic about commodities and there is already talk of a new super cycle, a thesis that, although it has yet to develop, we subscribe to.

There are several reasons to believe that the ongoing rally still has room for consolidation:

Goldman Sachs, which in late 2020 predicted a new "structural bull market" for commodities, argues that stimulus packages, such as China's new five-year plan, Europe's Green Deal and President-elect Joe Biden's planned package for the United States, -could have an impact similar to that of China's infrastructure buildout in the 2000s.

And recently, JP Morgan pointed out that commodities have started a super cycle that will last for years. The fight against climate change will have a positive impact as metals are required to build the necessary infrastructure in energy, batteries, EVs and there will be less supply of crude oil. China's growth, expansionary monetary policies, dollar weakness, inflation are other drivers. Commodities have had 4 super cycles in the last 100 years. The last one occurred in 2008 (peak) after 12 years of expansion.

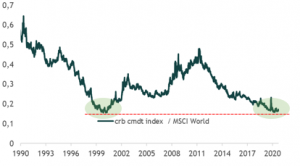

Relative performance Commodities vs Equity

CRB Commodity index