As we have mentioned in previous reports, historically peak inflation drove an easing of risk assets and the bond market, as long as a recession did not occur. On average, stocks have declined with rising inflation and approaching the peak, but may bounce back beyond previous highs, especially if a recession is avoided and stocks clearly outperform bonds in this scenario. In other words, if growth remains strong enough, the change in inflation momentum may signal a market trough. However, the downside risk to equities remains elevated if a recession materializes and equities may remain under pressure for another 6 months or so after the inflation peak: on average, the trough in activity data occurs 6 to 8 months after inflation has peaked.

The path for 2-year US rates was clearly biased to the downside, with the fed funds rate falling in 7 of the 11 instances of peak inflation since World War II. With inflation reaching much higher levels, the risk of inflation persistence today is higher, which could mean a continuation of tightening by the Fed despite falling inflation and the lingering risk of recession (otherwise reaffirmed in the minutes released this week).

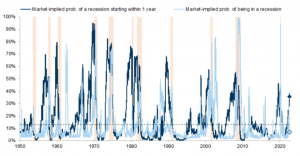

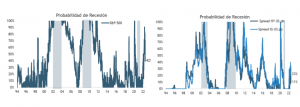

In fact, the market-implied probability of a recession in the U.S. in the next 12 months has remained high (see Chart No. 1). (see Chart No. 1), while the implied probability of being in recession in risky assets has declined sharply (see Chart No. 2), as the markets have (see Chart No. 2), as markets have recovered. In other words, markets have faded the risk of an imminent recession, but latent risks remain elevated.

Source: Fynsa Strategy; Bloomberg

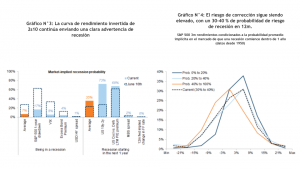

Source: Fynsa Strategy; BloombergMeanwhile, the U.S. yield curve remains deeply inverted and still points to persistent recession risks (see chart N°3). (see chart N°3). Moreover, the signal from the implied 12-month change in the fed funds rate is distorted as markets are pricing in large rate hikes through the end of this year, before cuts begin next year; historically, markets pricing Fed cuts are more consistent with elevated recession risk triggered by a tighter central bank.

And bear markets in stocks generally end with a steepening yield curve that coincides with a final stock drop; without that signal, downside risk remains elevated. As a recent Goldman Sachs report notes, if the probability of a recession in the next 12 months is above 40%, the risk of corrections is higher than normal: current levels are at 37% (see chart No. 4).

A final thought on the concept in vogue today in the markets: the "Fed pivot". In this regard, the 2019 experience is interesting as markets fell sharply in 4Q18, because the Fed intended to continue raising interest rates in 2019 to restrictive territory (which were just as they are now in "neutral" territory), in addition to starting balance sheet reduction. Well, that never happened, the fall of the markets ended up tipping the balance towards easing, long term inflation expectations fell as low with to 1.6% and the FED managed to avoid a recession with an "effective turn" of policy (lowering 75 bp rates in 2019). Then came the Covid-19 recession, but that's another story.

The reality today is quite different. Although break-even inflation expectations in the bond market have moderated, actual inflation remains elevated, and unlike 2019, where the market recovery coincided with a sharp turn in 2-year rates (evidently anticipating that the FED would lower interest rates), what we have today is that risk assets have recovered substantially, while interest rates, although they have not set new highs, do not show a greater inclination to fall, what we have today is that risk assets have recovered substantially, while interest rates, although they have not set new highs, do not show a greater inclination to fall, which keeps the yield curve inverted (see Chart No. 5).

All in all, unless the peak inflation narrative is confirmed by both the data and a moderate Fed pivot, we believe the risk of a return of rate shock and recession fears may again weigh on risk appetite, we believe the risk of a return of rate shock and recession fears may again weigh on risk appetite.