After U.S. inflation surprised to the downside for the first time in 18 months, markets have continued to recover ground, betting that U.S. monetary policy will be looser. While this is good news, investors should not get carried away, as a suitable Fed "pivot" is not yet on the table.

It is true that the U.S. consumer price index rose "only" 8.5% year-on-year in July, down from 9.1% in June and below the expected 8.7%.. The underlying CPI also rose by 5.9% y-o-y unchanged, when it was expected to increase by 6.1%. On a monthly basis, CPI was flat, the first time it has not increased since June 2020.

Such developments increase the likelihood that inflation will have peaked, or will do so soon. That, in turn, implies a less hawkish Fed, which may slow the pace of monetary tightening. In our view, that would mean raising the policy rate by "only" 50 bps at the next meeting, rather than another 75 bps. However, there are reasons to think that it is too early to bet on the Fed stopping rate hikes or tapering its quantitative tightening program.

Too early to assess the Fed's "pivot

In early July, we noted that there was some scope for an easing of the more acute fears of recession risk that were being discounted mainly in equities. SEE HERE.

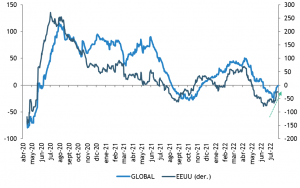

While we believe there are broad pressures toward slower growth, we also believe that the rotation from goods spending to services spending means that the weakness in the manufacturing sector likely overstates the state of the overall economy relative to more normal times.. Recent data have supported that notion, with significant upside surprises in activity data in both the services ISM and payrolls.

In this context, better growth news can provide some "cushion" for risk assets and help explain why stocks have continued to rally even as sovereign bond yields have been rising of late. While this may delay and dilute the impact of unwinding the Fed's pivot, such growth easing has clear limits. Some of the growth easing we have seen lately has clearly been driven by the easing on Fed risk.

And this is where we see the main problem. The stronger the growth outlook, the more the Fed will have to lean against easing financial conditions. If stocks rise further, that will ultimately mean that rates will also have to rise further, which should limit the potential for further recovery at least for the near term.

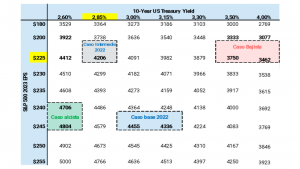

At 4,200 points (intermediate case 2022) the S&P 500 is at fairly "fair value" levels for the current reality of interest rates and earnings growth expectations. As recession risks "recede at the margin", the room for rates to continue to fall is limited and rather the balance of risks is tilted to the upside (we estimate fair value levels for the treasury 10 at levels closer to 3.0%) and on the other hand the room for upward revisions in corporate earnings is quite limited, if not outright zero, since a 2022 EPS of $225 per share for the S&P 500 already incorporates almost 10% earnings growth (too optimistic in our opinion). Thus, recoveries much larger than those seen so far in equities (base case 2022e 4,400 points) would no longer be in line with fundamentals and put the Fed in trouble.

S&P 500 year-end 2022 forecast based on 2023 estimated earnings per share, 10-year Treasury yield; yield gap of 2.5%.

The rise in equities, spread compressions, dollar falls and lower interest rate pressures contribute to looser financial conditions, which will make medium-term inflation convergence more difficult. In this sense, it is no coincidence that most of the interventions by Fed officials in recent days, even after the downward surprise in the July inflation figure, have a common denominator: "inflation is still too high" and "it is too early to declare victory in the fight against inflation".

All in all, recent developments increase the odds that inflation has topped out, or will do so soon and thereby stay further away from the market lows, but we believe it is too early for the market to trade on a "full Fed pivot". Looser financial conditions could revive inflation expectations, so be careful what you wish for....

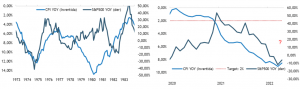

In the 1970s, peak inflation was the buying signal for stocks. Will history repeat itself this time, but without a recession?