July's business surveys reveal more clearly a global slowdown. The global all-industry PMI slipped broadly (including China), more than reversing June's gain and retreating to its lowest level of the expansion. At 50.8, the J.P. Morgan manufacturing PMI, the best single indicator of global activity, fell 2.7 points from June to a level consistent with annualized global GDP growth of 2.2%. While the implied pace of global GDP growth from the PMIs (2.2%) is a bit below potential (2.6%), the surveys do not yet point to the kind of sharp break that might be expected if the global economy had entered recession, as many fear.

However, this is not to say that there is no cause for concern, as the surveys highlight a number of areas of weakness. Coupled with a further drop in orders and expectations of future growth at expansionary lows, signs that labor markets may be turning more than expected are worrisome. Combined with a widespread downturn across sectors and countries, the July surveys underscore the heightened risks of a mid-year recession.

By sector both manufacturing and services appear to have slowed. The global manufacturing PMI fell 2.4 points last month to a level consistent with stagnant growth in the industrial sector. At the same time, the fall in the manufacturing PMI for new orders and the rise in the inventory PMI suggest that global industry has already contracted.

Meanwhile, the services PMI fell sharply last month by 2.8 points. While the decline is due in part to a surprisingly large 5.4-point collapse in the U.S. services PMI (which contrasts markedly with the increase reported in the non-manufacturing ISM, which unlike the PMI also includes government, construction, and mining), the decline was due in part to a surprisingly large 5.4 point collapse in the U.S. services PMI (which contrasts markedly with the increase reported in the non-manufacturing ISM, which unlike the PMI also includes government, construction and mining), sizable declines were published in all reporting countries except China and Russia.

A welcome development in the latest surveys is the signs of moderating inflationary pressures. Price indices remain elevated, but the declines are encouraging. However, even these signs carry a note of caution: the fall in the all-industry input and output price PMI could be as much (or more) a sign of weakening demand as it is of improving supply.

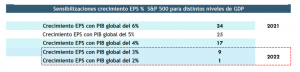

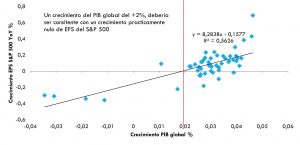

Finally, the sharp slowdown in global growth is a reminder that the market may be being overly optimistic about expected earnings growth in 2022 and 2023. Global growth closer to 2% should be consistent with no earnings growth for the S&P 500, while the market continues to expect growth closer to 10%.