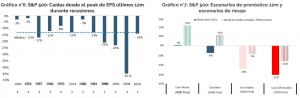

Following the release of the June CPI (again surprising to the upside), the US yield curve has begun to price in a higher probability of recession. While at the beginning of the year, markets mainly reflected inflation riskas rising bond yields weighed on risk assets, over the past two months, investors' concerns have shifted to recession risk.

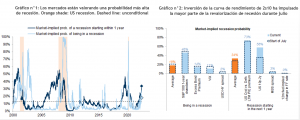

The market's implied probability of a U.S. recession has The implied market probability of a U.S. recession has so far increased along with the sell-off in equities, particularly in cyclical sectors.particularly in cyclical sectors. Equity and credit markets have traded fairly sideways since the beginning of Julyalthough the US yield curve has led the increase in the implied probability of recession (see charts n°1 and n°2).

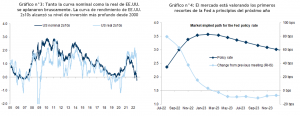

The slope of the U.S. 2s10s yield curve has reached its deepest level since 2000 (see chart n°3). U.S. 2s10s has reached its deepest inversion level since 2000 (see graph n°3).. The Fed's desire to "manage risk" around inflation has led the market to price in 15% to 30% of a 100bp hike at the next FOMC meeting (July 27), deepening the inversion of the yield curve.

Moreover, initial breakeven inflation has continued to decline due to fading inflation risk from the market (2-year inflation breakeven is trading near 3.0%, after peaking around 5% at the end of March) and caused a sharp flattening of the 2s10 real curve, which also points to a further price recession. However, the front end of the curve still implies a low probability of recession: fed funds futures are pricing in an overall increase in the policy rate over the next 12 months.The Fed's rate futures are not consistent with an imminent recession risk, and rate futures indicate further rate hikes for this year, but also expect the Fed to cut the policy rate in 2023 and 2024 (see chart n°4).

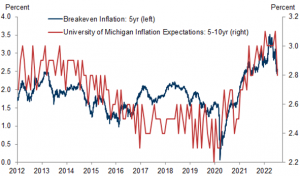

Looking ahead to next week's Fed meeting, the pullback in inflation expectations we believe reduces the impetus for a 100 bp hike. 5-10 year inflation expectations were revised down by 0.2 pp in the final June University of Michigan report and declined by 0.3 pp to 2.8% in the preliminary July report, 3-year inflation expectations in the New York Fed survey have declined by 0.3 pp since April, and market-based measures of inflation expectations have declined sharply, which should also ease concerns about expectations disanchoring. (see chart n°5).

It is precisely this moderation in longer-term inflation expectations, some stability in interest rates and a 2Q22 corporate earnings season that is progressing with slightly positive surprises, which has been behind the rebound in equities in recent weeks (+8% from the mid-June lows).

A recurring question these days relates to the resilience of corporate earnings and how inconsistent it seems, with recession risks on the rise, that the market continues to expect earnings growth of around 10% for S&P 500 companies.

The consensus expects earnings growth of around 6% yoy for the S&P 500 in 2Q. While companies are likely to beat estimates, cautious comments are expected to lead to cuts in forward estimates. Concerns are primarily focused on margin pressures and USD strength, although earnings weakness is still likely to be limited in the current slowdown as nominal GDP remains positive (supportive upper range) and wage growth lags corporate pricing (supportive margins).

In our baseline, assuming the economy avoids recession(see HERE), we expect the S&P 500 to rise to 4,400 points assuming earnings of US$225 per share this year and single-digit growth for next year in the range of US$240-US$245 per share (around consensus).

In a "moderate recession", assuming an "average earnings contraction" would imply an expected EPS of US$200 per share, which would be consistent with our "full recession" scenario of 3,300 points for the S&P 500 (see graph n°6 and n°7).