The last time we wrote about the dollar was earlier this year, when the dollar was 13% cheaper than it is today. Our bullish thesis was basically supported by a Federal Reserve that would be well ahead of the rest of the DM central banks in terms of monetary normalization (especially Europe), and that, therefore, rate differentials would tilt further in favor of the dollar.. See HERE

True, we have been surprised by the order of magnitude of the dollar's appreciation (locally that is doubly true), but let's understand that the dollar's uptrend has been feeding back on event after event, from the war in Ukraine, the shutdowns in China, the major inflationary surprises in the U.S. and more recently recession fears, especially in Europe.

For pedagogical purposes I think it is good to know what we are talking about when we refer to the global dollar, which is basically the basket measured by the U.S. Dollar index, (DXY Index), which is more commonly used on a daily basis, as opposed to other measures such as the Federal Reserve's trade-weighted dollar index (trade-weighted dollar).

The U.S. Dollar index is mainly composed of "hard currencies", where the Euro alone accounts for almost 60% of the index, followed by the Japanese yen with about 14% and the British pound with 12%.followed by the Japanese yen with about 14% weighting and the pound sterling with 12%.

You can understand then, that with a war in Europe, with the ECB (European Central Bank) practically "trapped" in terms of policy (despite the fact that Europe has as much inflation as the U.S.), it is no coincidence that the euro is "fighting" parity against the dollar, it is no coincidence that the euro is "fighting" for parity against the dollar.. The Japanese yen is also striking, a traditionally "safe haven" currency, but which has depreciated substantially against the dollar this year (-16%), this in a context of a monetary policy of yield curve control by the Japanese Central Bank, which of course has accentuated the appreciation of the yen against the dollar.(see graphs 1 and 2).

Another very relevant factor to consider is liquidity. Let us remember that the FED is not only raising interest rates, but also reducing its balance sheet, which is nothing more than withdrawing dollars from the market, as are other developed central banks. (see graph n°3 and n°4).

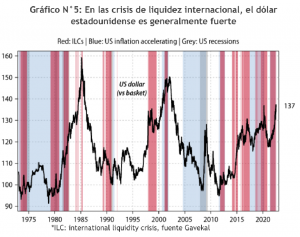

As a recent report by Gavekal states, what we may be facing is a liquidity crisis (see chart n°5). The US dollar is the currency in which international borrowing is most readily available. If it is excessively easy and cheap to borrow in US dollars for an extended period, i.e. if real US Treasury bill rates are negative for a long time, foreign investors will borrow heavily in US dollars, effectively creating a massive short position in the US currency.

And if foreign borrowers accumulate a massive short position in the US dollar, someday something will happen (e.g., a sharp rise in the price of oil) that will trigger a wave of short covering. And this will push up the US dollar exchange rate, triggering even more short covering.

This is what we are seeing today: The current liquidity crisis would be nothing more than an attempt to cover a historically large short position in the US dollar. The result is a marked change in the relative price of the U.S. dollar against the currencies of the rest of the world. This price revision has nothing to do with the fundamental values of the affected currencies and everything to do with market positioning, which in turn is the result of the ultra-loose policies pursued by the Fed and other central bankers over the past decade and more.

The most recent developments, such as the higher inflation surprises in the US, which leave the way clear for the Fed to hike further by 75bp at its meeting later this month, and the inversion of the yield curve (increasing recession risks), can only end in a stronger dollar going forward, so the loss of euro parity may only be a matter of time.

This is relevant, because as commonly happens in these cases, the loss of such important levels (some call them "psychological") usually brings more volatility. Technically, if the Euro consistently loses parity against the dollar, there are no weight references until the 0.85 - 0.90 range, which could potentially translate into an additional 8% to 10% appreciation of the dollar, up to its highs at 120.

A reversal of this trend is only to be expected around 4Q22 (barring of course an end to the war in Ukraine). (barring of course an end to the war in Ukraine), where inflation will probably become less of a concern and therefore give the FED some room for maneuver to "recalibrate monetary policy".

Regarding the dollar in Chile after the exchange rate intervention announced by the central bank, some convergence to the performance of international comparables is to be expected. If the exchange rate were more aligned to its comparables, the fair value should be closer to $900.