The year 2022 was full of bad news regarding the investment market, with a particular focus on the world of Venture Capital, where the drop in investments compared to the previous year was gigantic: according to Crunchbase, funding for startups fell by 35%. Added to this are the massive layoffs in the technology sector and also the collapse of cryptocurrencies. Despite this, which seems to be a very negative scenario, we can see a great moment to seize as an opportunity.

Many tend to be of the opinion that, after the boom seen in 2021 in this type of assets, such a drastic drop last year would mean the end for these investments. In fact, some -such as NotCo's CEO, Matías Muchnick- dared to say that 2023 would be the "startup graveyard". This happens when historical data and trends that are reflected in these certain cycles with negative periods are not well observed.

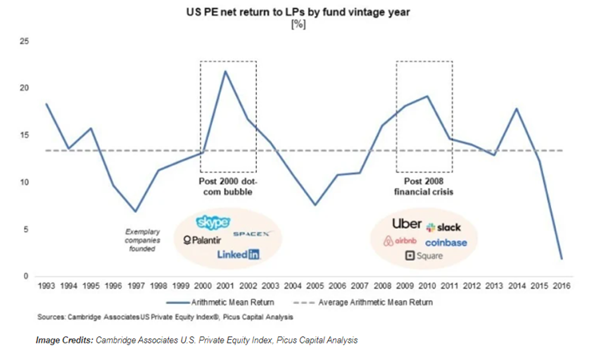

In fact, the data is quite compelling: if we take the period immediately after the two major crises of the 2000s, the dotcom and subprime crises, we find the two biggest peaks of returns for Venture Capital in that decade. Post dotcom, companies such as Skype, SpaceX, Linkedin and Platanir became global benchmarks (between 2000 and 2003), all still in place today. On the other hand, between 2009 and 2011, post "subprime", Uber, Slack, Airbnb and Coinbase, among others, appeared, achieving similar returns to the previous generation.

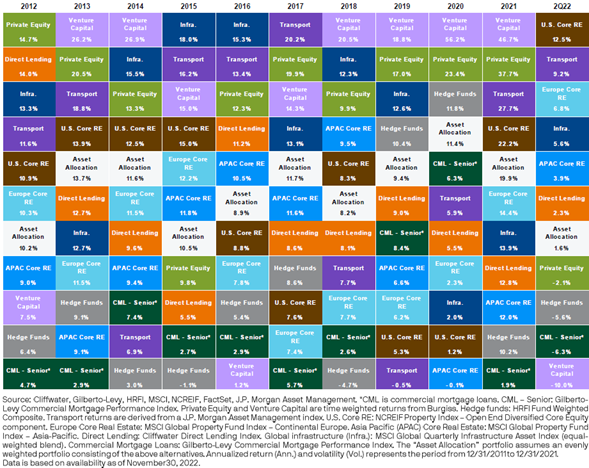

But this does not stop there, since, according to data provided by J.P.Morgan, in the last decade we can also observe how the worst performing years for this asset class were followed by years of absolute leadership over the other alternative asset classes: starting in 2012, where Venture Capital was in the lowest quartile of returns, then it had two years in a row offering the best returns in the market (over 26% in 2012), followed by two years in a row offering the best returns in the market (over 26% in 2012).then had two years in a row offering the best returns in the market (over 26% in both periods). The next big drop for the annualized return on startup investment was in 2016, where it ranked as the worst of the alternative assets, with a mere 1.2% return, but it quickly returned to the top ranks and was number one from 2018 to 2021, with historical returns in the last two periods with 56.2% and 46.7%, respectively.

This is a trend that has remained in force over the years and that indicates very strongly that, contrary to what many have indicated, we should watch very carefully what happens during this and the next few years with Venture Capital investments, contrary to what many have indicated, you should watch very carefully what happens during this and the next few years with Venture Capital investments. In fact, the great lesson is that you cannot lose sight of the next moves, since it is precisely in this period that the new generation of leading emerging companies worldwide will be created.

Tomás Latorre

Fynsa AGF Team