The international financial news agency recently published a brief outlook on the issues to watch out for in emerging markets.

The first, positive, point is that concerns about the financial health of emerging economies have abated, with most currencies showing a clear appreciation against the U.S. dollar so far this year.. The two exceptions, and very big ones, are Russia and Turkey, which have come out into the market to sell international assets to support their currencies.

In the case of Russia, it has gone to the market with its yuan reserves to compensate for the discount at which it is selling its oil, while in Turkey the Central Bank's intervention is estimated at some US$ 108 billion, in its effort to offset the effects of an excessively lax monetary policy.

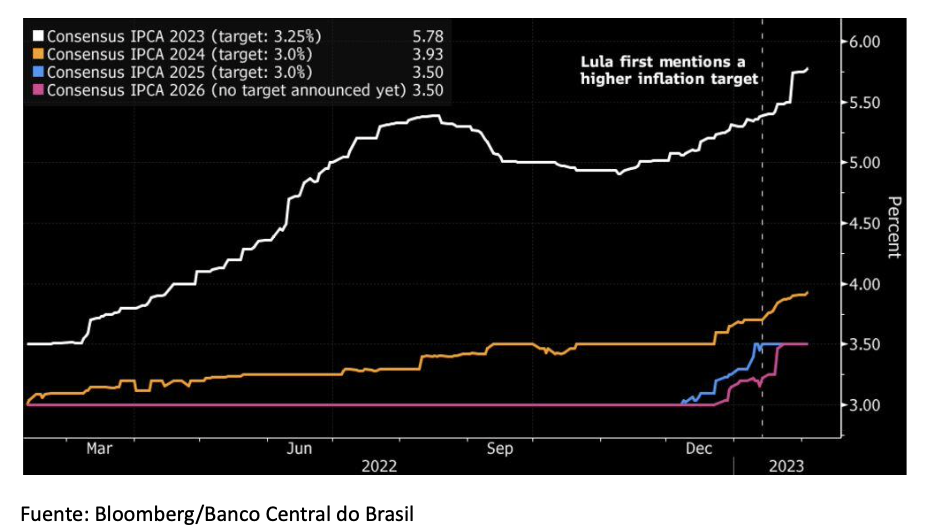

But while financial concerns have subsided, problems have arisen in the political and corporate governance arenas. Bloomberg notes that protests in Peru will cost the country 2 GDP points this year, while in Brazil, investors are concerned about President Luiz Inácio Lula da Silva's statements against the independence of the central bank, regarding interest rate hikes.s independence, in connection with the interest rate hike.

Finally, there are the risks of poor corporate governance. The recent events affecting the Adani group in India have raised doubts on the subject among Indian companies, which are undergoing an important process of growth and internationalization, although Bloomberg points out that its analysis suggests that the Adani case is an anomaly among corporations in the Asian country. Already in our neighborhood, the accounting inconsistencies of Americanas, a major Brazilian retail chain, have added a further element of concern regarding corporate debt.

Inflation expectations in Brazil