Last week we argued that different methodologies show an increasing, but still moderate, probability of a near-term recession in the U.S. ( https://www.fynsa.cl/newsletter/evaluando-los-riesgos-de-recesion-en-ee-uu/), but that high inflation is forcing the Fed to abandon counter-cyclical policy, which could effectively end in a recession and that today it is less likely that the "Fed will eventually save the market", since, if the Fed is determined to bring inflation down to target, they are likely to cause a lot of economic pain first.

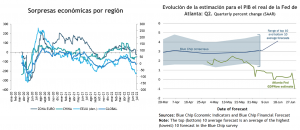

In this sense, new incoming data continue to show a marked slowdown and negative economic surprises have increased. Even more: judging by the Atlanta Federal Reserve's 2Q22 GDP estimates, the US economy could already be in recession, as its latest update points to a 1.0% GDP contraction, which adds to the already revised official figures for 1Q22, which showed a contraction of 1.6%.

Market prices, meanwhile, are also beginning to incorporate a growing risk of recession. The more than 20% drop in equities from their January highs has been compounded by a sharp adjustment in commodities, (copper prices, for example, have fallen almost 20% in the last 4 weeks) and US treasury interest rates have already retreated more than 50 basis points from their mid-June highs (the 10-year treasury is back below 3,0%) and fed funds rate expectations already incorporate virtually 3 rate cuts by 2023 (from the 3.5% it would reach by December of this year, which as things are evolving, may not be reached).

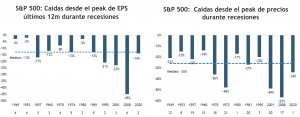

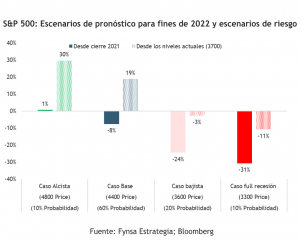

But if there were indeed a recession, what would it look like?

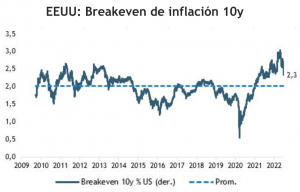

What we have today, meanwhile, is that while most survey-based measures of inflation remain at multi-decade highs, market-based readings do not account for further inflationary de-anchoring..... Moreover, recently, they have even moderated quite a bit. Ten-year inflation breakevens have returned to 2.3%, within their 1.5% to 2.5% range of the past two decades. If it falls to 2% or below, the Fed will likely soften its tone and slow the pace of rate hikes.

All in all, recent developments do not greatly change our conclusions: that the markets, and in particular equities, already largely price in an "average recession" and that the potential market bottom would not be that far off the lows already realized. Of course, volatility will persist for a while, and there is a risk of "candor" in corporate earnings expectations, as it is not consistent, given rising recession risks, for the market to continue to incorporate around 10% corporate earnings growth for this year. Also, do not expect corporate earnings to suffer a large plunge, since as is generally the case in inflationary periods, "nominal prices cushion real volume weakness".