During May we argued that the forces pushing down stock prices might begin to abate: the war in Ukraine no longer seemed likely to escalate into a broader conflict; the number of new Covid cases in China was declining; and global inflation might be peaking. See more. Against that backdrop, we believed that equity markets were pricing in too much recession risk and that this probability for the next 6 to 12 months, although increasing, was still low and, therefore, we maintained a still pro-risk stance. See more.

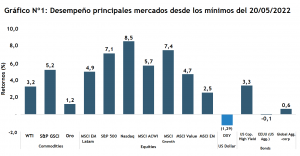

Fast forward to today and the easing of concerns about monetary policy/recession risk, helped generate a relief rally in recent weeks, which has been broad-based across assets and regions. (see charts N°1).

Source: Fynsa Estrategia; Bloomberg. Data as of June 02, 2022

Source: Fynsa Estrategia; Bloomberg. Data as of June 02, 2022

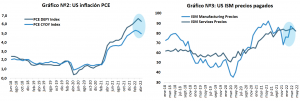

We believe that the market has already absorbed and largely appreciated the change in monetary policy and the significant tightening of financial conditions, as inflation may be peaking or at least somewhat stabilizing (see Figures 2 and 3). as inflation may be peaking or at least stabilizing somewhat (see Figures 2 and 3). In this context, temporary and base effects are likely to bring inflation down, which would optimistically allow the Fed to take a break before the important US mid-term elections next November.

Source: Fynsa Strategy; Bloomberg

Source: Fynsa Strategy; Bloomberg

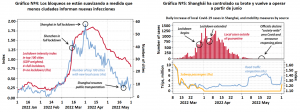

Regarding China, the two largest cities are taking significant steps toward reopening as Covid outbreaks have been brought under control. As of June 1, most of Shanghai's 25 million residents were allowed to leave their homes and neighborhoods, subject to frequent Covid testing. Beijing began easing restrictions in most districts on May 29, although it continues to struggle with sporadic outbreaks and has no timetable for reopening the entire city (see Figures 4, 5 and 6).

Most cities, including Shanghai and Beijing, will continue to impose a number of relatively tough Covid prevention measures for the foreseeable future, which will affect consumption.. However, with the end of Shanghai's strict confinement, the most severe disruption to supply chains should be over for now, and manufacturers can begin to recover.

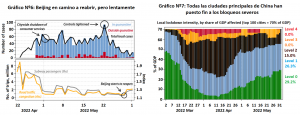

The rest of the country continues to gradually improve. Just over half of the top 100 cities have removed all restrictions, and some localities announced further opening measures after Premier Li Keqiang's teleconference with local officials last week (see chart No. 7).

Source: Gavekal

Source: Gavekal

Regarding the future trajectory of the market, higher inflation and slower growth are now the consensus view, which will likely continue to generate greater volatility. Our best guess is still that the U.S. economy will manage to avoid a recession, at least not an imminent one, so expected earnings growth would not be compromised. (see chart N°8). Under these assumptions, prices much lower than 4,000 points for the S&P 500 are still not justified and we maintain our estimates of fair value levels closer to 4,500 points (+10%).

Source: Fynsa Strategy; Bloomberg

Source: Fynsa Strategy; Bloomberg