Last week we argued that most of the adjustment in equities so far this year is multiple compression, given higher interest rates, and that we believed the forces that pushed equity prices lower may begin to abate: the war in Ukraine no longer seems likely to escalate into a broader conflict; the number of new Covid cases in China continues to decline, which has allowed the economy to open up further; and global inflation may be bottoming out. See (https://www.fynsa.cl/newsletter/estrategia-3/).

However, risk markets have continued to sell off this week and government bonds have risen (rates have fallen). These market movements are consistent with market perceptions of an increased likelihood of recession.

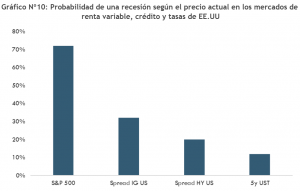

The question then becomes. How much of a recession are the markets pricing in?

Recognizing that there is no perfect way to infer recession probabilities from market prices, examining a variety of approaches across asset classes may be more helpful, as a recent JP Morgan report notes.

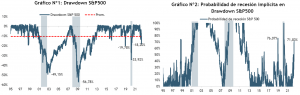

Stocks: the simplest way to assess how much is included in the price of a U.S. recession is to use the average 26% drop in the S&P500 index over the last 11 recessions (see chart No. 1). (see chart No. 1). So far, the S&P500 has fallen by 18.6% from its peak (as of May 19), so stock markets are pricing in an 18.6/26 = 72% probability of recession (see chart No. 2).

Source: Fynsa Estrategia; Bloomberg; JP Morgan. Blue bars correspond to recessions.

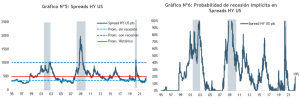

Source: Fynsa Estrategia; Bloomberg; JP Morgan. Blue bars correspond to recessions.CreditThe average level of GI spreads during recessions (the last six) is 250 bps, and the average level outside the recession is 100 bps (see chart N°3). (see chart N°3). In this case, the recommendation is to use averages rather than peaks and troughs, due to the extreme behavior of post-Lehman credit spreads, which biases the relatively limited data history, especially for high yield credit.

IG US spreads have widened considerably in recent weeks and stand at 148 bps over Treasuries as of May 19 (around their historical averages). (around their historical averages). This suggests that the price of IG credit markets has a probability of (148-100) / (250-100) =32% of US recession (see chart N°4).

Source: Fynsa Estrategia; Bloomberg; JP Morgan. Blue bars correspond to recessions.

Source: Fynsa Estrategia; Bloomberg; JP Morgan. Blue bars correspond to recessions.Meanwhile, HY US spreads have widened to 480 bps on treasury bonds.. This compares to an average recession level of HY spreads (over the last three) of 1000 bps and an average off-recession level of 350 bps. (see chart N°5). The same calculation suggests that US HY spreads are priced at (480-350) / (1000-350) = 20% recession probability. In other words, U.S. HY credit appears to have a much lower probability of recession relative to U.S. IG credit (see Chart #6).

Source: Fynsa Estrategia; Bloomberg; JP Morgan. Blue bars correspond to recessions.

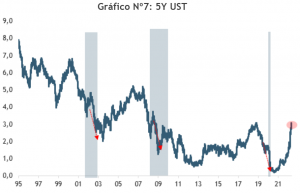

Source: Fynsa Estrategia; Bloomberg; JP Morgan. Blue bars correspond to recessions.Government bonds: If we use five-year U.S. Treasury yields as a benchmark, they fell on average 200 bps in during the last three recessions (measured from the peak in the months prior to the start of the recession to the trough during the recession) (see Chart No. 7). That compares to a drop of about 24 bps in 5-year Treasury yields from the May 6 peak to May 19. This suggests that the Treasury market is pricing in around 24bp/200bp = 12% probability of a US recession, a low probability to which I would add that the slope of the curve is still positive (see Chart #8 and #9).

Source: Fynsa Estrategia; Bloomberg; JP Morgan.

Source: Fynsa Estrategia; Bloomberg; JP Morgan.In total, the U.S. equity markets quote a very high probability of recession of 72%. The corresponding pricing of a recession by the IG US credit markets exceeds 30%, while HY credit is pricing close to a 20% probability of recession. In contrast, the rates markets are pricing a fairly low recession probability of 12%, which creates a divergence with the equity markets in particular. Either the equity markets are right and a recession occurs, inducing much larger declines in bond yields, or the rates markets are right and a recession is avoided inducing a recovery in equity markets.

Our view remains that equity markets are pricing in too much recession risk and that the probability of recession over the next 6 to 12 months, although increasing, is still low and therefore we maintain a pro-risk stance.