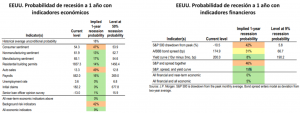

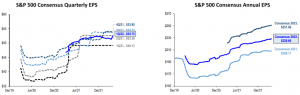

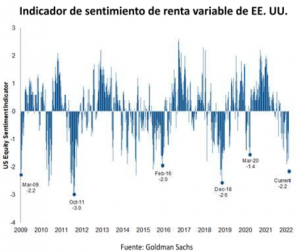

The prevailing narrative in the financial markets is that the Federal Reserve (Fed) is significantly behind in its monetary policy and that, by accelerating its pace of rate hikes, it will almost inevitably trigger a recession in the U.S. This explains why the S&P500 is down approximately 10% for the year.

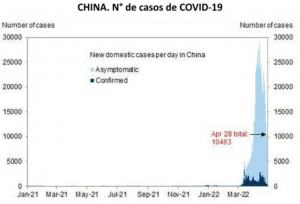

Of course these fears have been fed back by geopolitical risks and more recently by the expectation that Chinese demand will collapse due to blockades.

This week we would like to highlight several points that contradict the dominant market view:

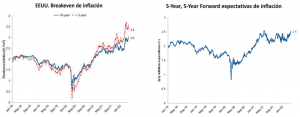

Meanwhile, measures of inflation expectations also support the view that the Fed is not perceived to be as "lagging" as some market observers suggest. Break-even inflation rates, as measured by the spread between Treasury inflation-protected securities (TIPS) and Treasury bonds with comparable maturities, stand at 3.4% for 5-year bonds and 3.0% for 10-year bonds.

Another longer-term measure, the markets' estimate of what 5-year breakeven rates will be, 5 years forward, shows inflation expectations at 2.5%, which is only modestly above the Fed's 2% target considering that CPI has historically exceeded the Fed's preferred PCE inflation measure by about 30 basis points.

Details from a Politburo meeting this week, pledges further policy support to meet the country's economic growth target for the year.i) strengthen macro adjustments, ii) support healthy growth of platform enterprises, iii) plan incremental policy tools, iv) make efforts to boost domestic consumption, and v) push for healthy development of the real estate market. Chinese leaders also pledged to ensure "supply chains in key sectors" and smooth transportation logistics, committing to "respond positively" to the demands of foreign-invested enterprises for a smoother business operating environment.

The latest stimulus pledge comes just days after China's President Xi, highlighted infrastructure as a major focus for the government as growth comes under pressure.

Still, if a recession is avoided (the base case for now), history shows us that staying invested in stocks is the right strategy. However, even if a recession occurs in the next few years, it is too early to reduce equity exposure.